Summary

In July-September FY22, total export earning from Readymade Garments (RMG) stood at USD 9059.44 million (Woven USD 3895.26 million and Knitwear USD 5164.18 million) which was 13.69 percent higher than that of the previous quarter and 11.48 percent higher than that of the corresponding quarter of last year aided by various continued policy initiatives by government and Bangladesh Bank.

In July-September FY22, total export earning from RMG was 7.48 percent higher than that of the quarterly target of USD 8428.90 million.

During July-September of FY22, the main destinations of Bangladesh’s RMG were the USA, Germany, UK, Spain, France, Netherlands, Italy, Canada, and Belgium. Total RMG export earnings from these countries stood at USD 6616.70 million or 89.66 percent of the total RMG exports.

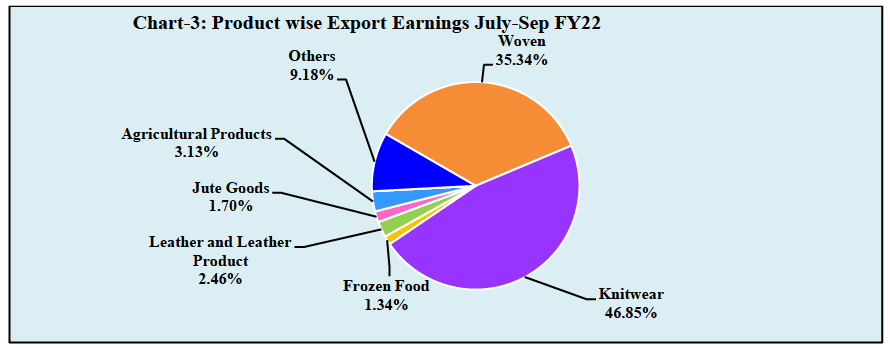

The net export of RMG (as calculated by subtracting import value of RMG raw materials from RMG export value) was USD 4839.50 million or 53.42 percent of gross RMG export in this quarter.

The exports earning from Readymade Garments (RMG) sector in Bangladesh has rebounded (13.69 percent) in July-September quarter, even this sector smashed by global supply chain disruptions along with serious underutilized domestic production capacity due to COVID-19 pandemics. Besides, the quarterly export earning from RMG was 7.48 percent higher than that of the quarterly target. The lofty demand from our corresponding buyers like the USA, UK, Canada, EU is generating a new expectation in RMG sector in Bangladesh.

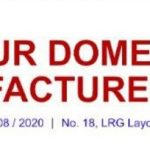

The contribution of RMG sector to GDP stood at 8.86 percent in FY21. At the same time, Bangladesh’s total export earnings from RMG stood at USD 31456.73 million which was 12.55 percent higher than that of the previous fiscal year (Chart-1).

The contributions of RMG sector and non-RMG products to total export earnings in FY21 were shown in Chart-2.

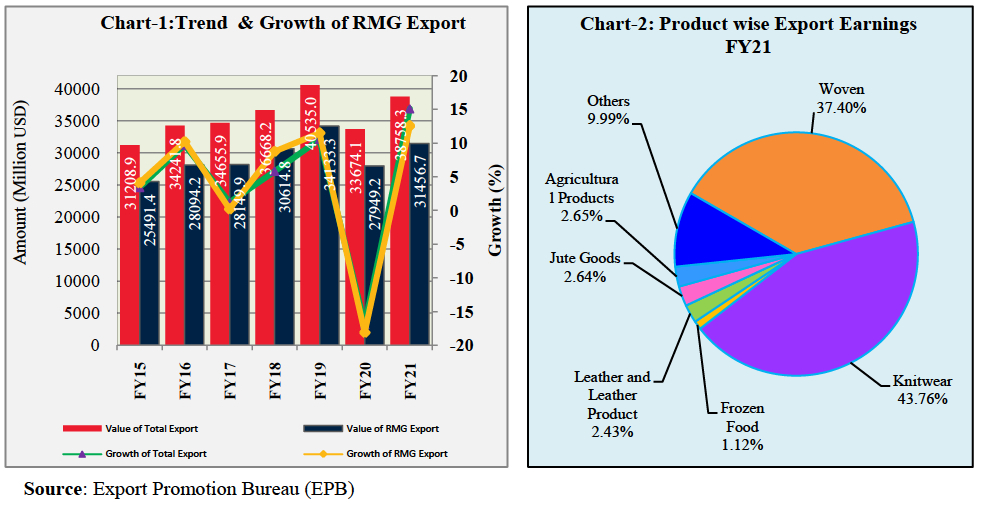

During July-September of FY22, total export earnings from RMG increased by 13.69 percent compared to that of the previous quarter. During this quarter, total export earnings from RMG were 7.48 percent higher than the quarterly target due to gradual improvement of COVID-19 situation. Product-wise export earnings showed that the contribution of woven garments and knitwear to total export earnings stood at 35.34 percent and 46.85 percent respectively during the quarter under report (Table-1). In this quarter, the contributions of non-RMG products to total exports earnings were as follows: agricultural products (3.13 percent), leather and leather products (2.46 percent), jute goods (1.70 percent), frozen food (1.34 percent) and other products (9.18 percent) (Chart 3).

Knitwear

After a tenuous rise of export in previous quarter, the export earning from knitwear in July- September FY22 regained its momentum and stood at USD 5164.18 million, which was 19.93 percent higher than that of the previous quarter and 15.69 percent higher than that of the same quarter of the preceding year. Moreover, knitwear export was 10.33 percent higher than the export target for the quarter under report (Table-1). Quarterly export earnings from knitwear are shown in Chart-4.

Woven Garments

Alike knitwear, export earning from woven garments rebounded and stood at USD 3895.26 million during the first quarter of FY22, which was 6.34 percent higher than the previous quarter’s export earning and 6.35 percent higher than the same quarter of the preceding year.

Again, woven garments export was 3.92 percent higher than the export target of that quarter (Table-1). Quarterly export earnings from woven garments are depicted in Chart-4.

| Table-1: Export of Readymade Garments (From FY’16 to Jul-Sep, FY’22) | (Million USD) | ||||||||

| FY | Total Export | Woven Garments | Knitwear | Total RMG (Woven + Knitwear) | Percentage | Share in Total Export | |||

| Target | Actual | Target | Actual | Woven Garments | Knitwear | Total | |||

| 1 | 2 | 3 | 4 | 5 | 6 | 7=(4+6) | 8=(4+2) | 9=(6+2) | 10=(8+9) |

| FY 16 | 34241.82 | 14105.42 | 14738.74 | 13266.21 | 13355.42 | 28094.16 | 43.04 | 39 | 82.05 |

| FY17 | 34655.92 | 16210 | 14392.59 | 14169 | 13757.3 | 28149.89 | 41.53 | 39.7 | 81.23 |

| FY18 | 36668.17 | 15060 | 15426.25 | 15100 | 15188.51 | 30614.76 | 42.07 | 41.42 | 83.49 |

| FY’19 | 40535.04 | 16539 | 17244.73 | 16150 | 16888.54 | 34133.27 | 42.54 | 41.66 | 84.21 |

| Jul-Sep FY20 | 9647.99 | 4612.95 | 3887.34 | 4493.76 | 4170.22 | 8057.56 | 40.29 | 43.22 | 83.52 |

| Oct-Dec FY20 | 9654.17 | 4797.1 | 3930.88 | 4673.14 | 4035.58 | 7966.46 | 40.72 | 41.8 | 82.52 |

| Jan-Mar FY20 | 9671.67 | 5004.21 | 4330.95 | 4874.9 | 3748.75 | 8079.7 | 44.78 | 38.76 | 83.54 |

| Apr-Jun FY20 | 4700.26 | 4935.74 | 1892.02 | 4808.2 | 1953.45 | 3845.47 | 40.25 | 41.56 | 81.81 |

| FY’20 | 33674.09 | 19350 | 14041.19 | 18850 | 13908 | 27949.19 | 41.7 | 41.3 | 83 |

| Jul-Sep FY21 | 9896.84 | 4025.39 | 3662.72 | 3934.68 | 4463.66 | 8126.38 | 37.01 | 45.1 | 82.11 |

| Oct-Dec FY21 | 9336.61 | 4173.74 | 3356.67 | 4079.69 | 4062.51 | 7419.18 | 35.95 | 43.51 | 79.46 |

| Jan-Mar FY21 | 9704.9 | 4418.35 | 3814.35 | 4318.78 | 4128.01 | 7942.36 | 39.3 | 42.54 | 81.84 |

| Apr-Jun FY21 | 9819.96 | 4467.52 | 3662.96 | 4366.85 | 4305.85 | 7968.81 | 37.3 | 43.85 | 81.15 |

| FY’21 | 38758.31 | 17085 | 14496.7 | 16700 | 16960.03 | 31456.73 | 37.4 | 43.76 | 81.16 |

| Jul-Sep FY22 | 11021.95 | 3748.44 | 3895.26 | 4680.46 | 5164.18 | 9059.44 | 35.34 | 46.85 | 82.19 |

| Source: Export Promotion Bureau, Bangladesh | |||||||||

*Shaded area denotes the export earnings during Covid-19

Import of Raw Materials and Net Exports

During July-September of FY22, the import value of raw materials (raw cotton, synthetic/viscose fibre, synthetic/mixed yarn, cotton yarn, and textile fabrics and accessories for garments) stood at USD 4219.94 million, which was 46.58 percent of total export earnings from RMG sector.

Therefore, the net export from this sector stood at USD 4839.50 million, which was 15.98 percent higher than that of the previous quarter but 8.35 percent lower than that of the same quarter of the preceding year. Import of raw materials and net export based on L/C statement (FEOD) from FY19 (July-September) to FY22 (July- September) are shown in chart-5 and table 2.

| Table-2: Trends of net exports from RMG sector in context of raw materials import

(Million USD) |

|||

| Fiscal Year | RMG Export A | Raw Materials ImportB/ | Net export in RMG |

| 1 | 2 | 3 | 4=2-3 |

| Jul-Sep FY19 | 8191.67 | 3240.83 | 4950.84 |

| Oct-Dec FY19 | 8893.24 | 3040.68 | 5852.56 |

| Jan-Mar FY19 | 8866.51 | 3088.16 | 5778.35 |

| Apr-Jun FY19 | 8181.85 | 2808.64 | 5373.21 |

| Jul-Sep FY20 | 8057.56 | 3349.17 | 4708.39 |

| Oct-Dec FY20 | 7966.46 | 3201.95 | 4764.51 |

| Jan-Mar FY20 | 8079.70 | 3427.93 | 4651.77 |

| Apr-Jun FY20 | 3845.47 | 2290.85 | 1554.62 |

| Jul-Sep FY21 | 8126.38 | 2845.83 | 5280.55 |

| Oct-Dec FY21 | 7419.18 | 2847.81 | 4571.37 |

| Jan-Mar FY21 | 7942.36 | 3366.55 | 4575.81 |

| Apr-Jun FY21 | 7968.81 | 3795.97 | 4172.84 |

| Jul-Sep FY22 | 9059.44 | 4219.94 | 4839.50 |

A/Export Promotion Bureau.

B/From July- September 2018, we considered the value of the components -raw cotton, synthetic/viscose fibre, synthetic/mixed yarn, cotton yarn and textile fabrics and accessories for garments instead of back to back L/Cs raw materials (FEOD, Bangladesh Bank).

Source: Own calculation of Research Department.

Destination of RMG

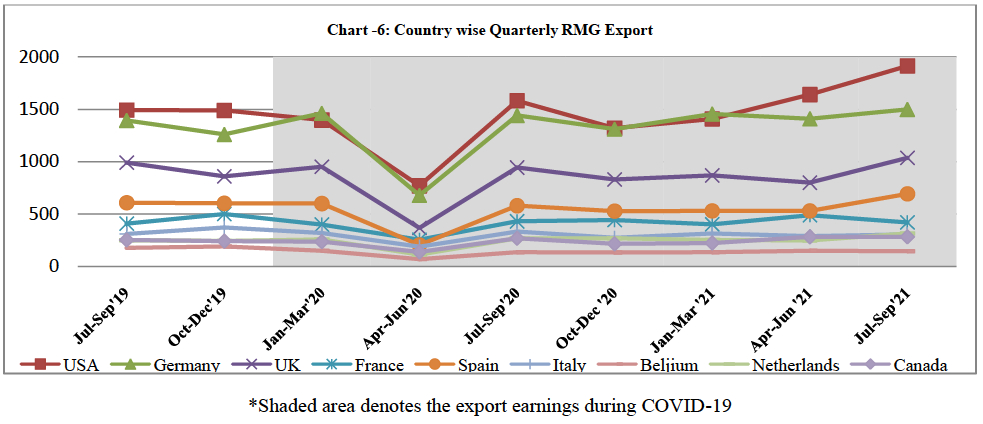

The main destinations of Bangladesh’s RMG are the USA, Germany, UK, Spain, France, Netherlands, Italy, Canada, and Belgium (Chart-6). During July-September of FY22, total export earnings from these countries stood at USD 7380.10 million; of which 89.66 percent or USD 6616.70 million was earned from the RMG (woven 44.10 percent and knitwear 55.90 percent) export (Table-3). During the quarter under report, RMG export earnings from these nine countries increased by 13.41 percent as compared to that of the previous quarter and this was 10.53 percent higher than that of the corresponding quarter of the preceding fiscal year.

| Table-3: | Country wise RMG Export in July-September, FY22 | (Million USD) | |||||

| Countries | Total Export | Woven Garments | Knitwear | Total

RMG |

Other Exports | Share of RMG in Total Export (%) | Others Share in Total Export (%) |

| 1 | 2 | 3 | 4 | 5=(3+4) | 6=(2-5) | 7 15-) | 8=(6-2) |

| USA | 2208.3 | 1171.12 | 741.26 | 1912.38 | 295.92 | 86.60 | 13.40 |

| Germany | 1592.25 | 586.22 | 910.8 | 1497.02 | 95.23 | 94.02 | 5.98 |

| UK | 1114.8 | 370.63 | 665.52 | 1036.15 | 78.65 | 92.94 | 7.06 |

| France | 482.34 | 1333.92 | 287.73 | 421.65 | 60.69 | 87.42 | 12.58 |

| Spain | 741.42 | 290.26 | 403.95 | 694.21 | 47.21 | 93.63 | 6.37 |

| Italy | 330.12 | 290.26 | 403.95 | 306.92 | 23.2 | 92.97 | 7.03 |

| Belgium | 196.02 | 47.36 | 100.49 | 147.85 | 48.17 | 75.43 | 24.57 |

| Netherlands | 390.26 | 116.94 | 198.54 | 315.48 | 74.78 | 80.84 | 19.16 |

| Canada | 324.59 | 126.48 | 158.56 | 285.04 | 39.55 | 87.82 | 12.18 |

| Sub-Total | 7380.1 | 2918.08 | 3698.62 | 6616.7 | 763.4 | 89.66 | 10.34 |

| Others Countries | 3641.85 | 977.18 | 1465.56 | 2442.74 | 1199.11 | 67.07 | 32.93 |

| Total | 11021.95 | 3895.26 | 5164.18 | 9059.44 | 1962.51 | 82.19 | 17.81 |

| Source: Export Promotion Bureau, Bangladesh | |||||||

Recent Measures Taken by the Government, Bangladesh Bank and Other Stakeholders

The government has taken a number of measures to increase RMG production and boost up RMG export. Following funds are important: Financial Stimulus Fund: A financial stimulus fund worth of BDT 50.00 billion was formed from the budgetary allotment of the government to combat the negative impact of Covid-19 on exports for paying a maximum of three months’ salaries and allowances to the workers-staffs of the export oriented industries. Entrepreneurs of such industries can take loans from this fund through banks at two percent service charge. (BRPD Circular No 07, Date 02 April, 2020).

Borrowers enjoyed additional 180 days as grace period for repayment installment facility against loans from March 2021. After the end of grace period (applicable till 30 September 2021), the remaining portion of loan must be paid with 18 EMI (BRPD Circular No 15, Date 24 Feb, 2021).

Pre-shipment Credit:

To continue the export activities of export oriented RMG industries amid the Corona Virus pandemic, Bangladesh Bank has formed a refinance fund worth of BDT 50.00 billion. RMG entrepreneurs can take loans from this fund through banks at 6 percent rate of interest (BRPD Circular No 9, Date 13 April, 2020). Recently, for the betterment of economic growth in export sector, BB reduced the interest rate on this refinance fund from 6 percent to 5 percent at receiver level and 3 percent to 2 percent at bank level (BRPD Circular No-26, Date 26 April, 2021). Bangladesh Bank has expanded the tenure of loan facilities for entrepreneurs from 01 year to 03 years under this refinance scheme. Entrepreneurs can avail the loan more than one times within the mentioned period (BRPD circular no: 44, Date 30 September 2021).

Export Development Fund (EDF):

Loan limit facility from EDF has been enhanced from the existing limit of USD 25 million to USD 30 million against foreign currency financing of input procurement for member mills of BGMEA and BTMA until 30 June, 2021 (FE Circular No. 05, Date 27 January, 2021). Moreover, the member mills of BKMEA can borrow a maximum limit of USD 20 million as single borrower (FE Circular No. 09, Date 25 February, 2020). BB reduced the interest rate on EDF loans from 2.00 percent to 1.75 percent per annum at borrower level until March 31, 2021. (FE Circular No-47, Date 28 October, 2020).

Incentives for Export expansion:

During the FY22, to encourage the country’s export trade, export subsidies or cash incentives have been given for some export items to be effective from 1 July 2021 to 30 June 2022. Among them, 4 percent cash incentive has been fixed for export oriented garments sector, small & medium industry of garments sector and to help expanding the new items/ new market garments sector (excluded USA, Canada, UAE). Inspite of existing 4 percent cash incentive , additional 2% has been given as support for the exporters of garments sector of EURO zones. Morever, 1 percent special cash incentive has been fixed for RMG sector (FE Circular No-29, Date 20 September, 2021).

Conclusion

RMG export is the prime source of foreign earnings in Bangladesh as it covers 82.19 percent of our total export earnings and 86.08 percent of industrial products exports in July-September quarter of FY22. After withdrawal of nation-wide lockdown, the production and export of RMG started to accelerate gradually. To regain the RMG sector in its previous position, various proactive initiatives such as reinstate the cancellation orders from international buyers, smooth supply chain of accessories, reduce container fares, raise production capacity of factories, low cost refinance schemes, production of costly diversified products instead of basic and low price products etc should be taken by the government and Bangladesh bank.