China Textile Network reported that prices of polyester and nylon fiber surged since May after cost climbed up, while those of spandex extended lower amid unbalanced supply and demand. Feedstock of spandex, BDO-PTMEG, was mainly from coal chemical industry, having feeble support from firm oil price. Weak spandex value chain and in expectation of weaker performance further accelerated the inner competition on spandex market.

Price: spandex declined more than other textile and apparel raw materials

Price of most textile and apparel raw materials increased since May while that of spandex was weak, with decrement of 40D at 7,500yuan/mt or 15.3% to 41,500yuan/mt by Jun 13. Price of PFY and NFY advanced by near 10-20%, that of cotton yarn inched down and that of rayon yarn slightly rose. The decrement of spandex 40D outpaced that of other textile and apparel raw materials.

| Price of major textile and apparel raw materials since the May Day holiday (Unit: yuan/mt) | |||||

| Date | Chemical fiber | Cotton textiles | |||

| Spandex 40 D | Polyester POY 150/48 | Nylon 6 FDY 70D/24 F | Cotton yarn 40S | Rayon yarn 30s | |

| 5-May | 49,000 | 7,935 | 18,350 | 29,390 | 18,220 |

| 13-Jun | 41,500 | 9,325 | 19,350 | 28,970 | 18,550 |

| Change | -7,500 | 1,390 | 1,000 | -420 | 330 |

| Change (%) | -15.30% | 17.50% | 5.40% | -1.40% | 1.80% |

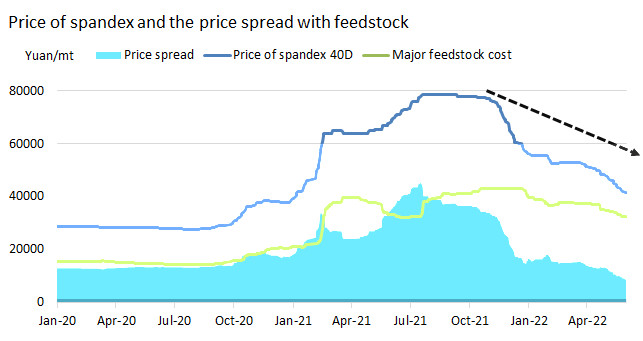

Price disparity: hitting historic new low

With decreasing spandex prices, the price spread has been narrowed to historic low. Price of spandex 40D dropped far more than its major feedstock since the fourth quarter of 2021, with decrement of spandex 40D as high as 47.1% and that of PTMEG and MMDI only around 24.1%. The price spread between spandex 40D and its major raw materials shrank to 8,794yuan/mt, even more than 4,000yuan/mt lower than the sluggish period in Q1 2020. Spandex companies saw bigger losses, and more units cut production in East China.

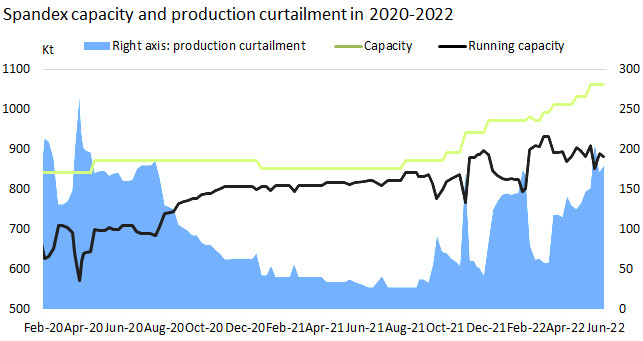

Supply: increasing units scale down output

Increasing spandex factories cut output since Q2 2022 when the spread of pandemic remained, the inventory burden intensified and more varieties became unprofitable. Above 180kt/year of spandex capacity was suspended now. The spandex capacity has been at 1,061.5kt/year in Chinese mainland after new units intensively started operation in Q4 2021 and H1 2022. The capacity of existing units increased by 7.4% on the year. Units in East China only ran at 76% of capacity and those with capacity below 20kt/year only ran at above 40% of capacity. Factories in Middle and West China still ran at above 90% of capacity. The operating rate of spandex industry was at 83% on the whole.

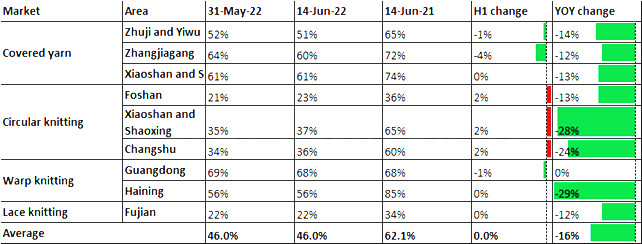

Fabric mills: operating rate apparently lower on the year

Fabric mills witnessed improving orders but the improvement was not apparent. Stocks of fabrics declined slowly. The capital turnover met bigger resistance. Some orders were rerouting out of China to emerging markets like Southeast Asia and India. The operating rate of fabric mills was still lower on the same period of last year, especially circular knitting field. With rapidly declining spandex prices, fabric mills reverted producing high-density circular knitting fabrics with high content of spandex (15-50%). In addition, circular knitting plants were cautious in hoarding up stocks when the production efficiency was high, orders were insufficient and there were rich varieties. Most circular knitting plants chose to run at low capacity.

By Jun 14, the operating rate of fabric mills was divided, with that of air covered yarn plants and cotton core-spun yarn plants at above 60%, that of warp knitting mills in Guangdong at around 70%, that of conventional covered yarn plants in Zhuji and Yiwu and warp knitting plants in Haining at 50-60%, that of circular knitting plants in Zhejiang, Jiangsu, Chaozhou and Shantou from Guangdong and Quanzhou, Fujian at around 40% and that of circular knitting plants in Foshan, Guangdong and lace knitting mills in Fujian at above 20%. After the production of autumn and winter fabrics such as dralon fabrics and fabrics for sweater grew, some plants slightly ramped up operating rate.

Supply and demand of spandex is unbalanced. New spandex increased by above 200kt on the year, while domestic and export demand both presents weak. The Russia-Ukraine conflict still affects overseas consumption. Domestic consumption recovers slowly in China when the spread of pandemic eases. Fabric mills meet resistance in chasing up the cost. Price competition remains obvious when spandex suppliers encounter selling pressure. Weak fabric market gradually transfers to spandex and upstream market. Eyes are suggested to the production curtailment of spandex companies and the operation status of PTMEG market.