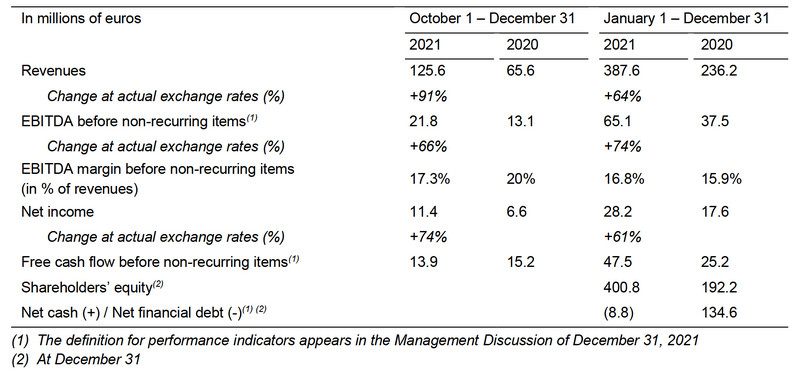

2021: very strong increase in revenues and earnings thanks to the rebound in activity and the acquisition of Gerber Technology

- Revenues: 387.6 million euros (+64%)*

- EBITDA before non-recurring items: 65.1 million euros (+74%)*

- Net income: 28.2 million euros (+61%)*

- Free cash flow before non-recurring items: 47.5 million euros

- Dividend**: €0.36 per share (+50%)

* At actual exchange rates ** Proposed to the Annual Shareholders’ Meeting on April 29, 2022

Paris, February 9, 2022. Today, Lectra’s Board of Directors, chaired by Daniel Harari, reviewed the consolidated financial statements for the fiscal year 2021. Audit procedures have been performed by the Statutory Auditors. The certification report will be issued at the end of the Board of Director’s meeting of February 23, 2022.

These financial statements incorporate the acquisitions of Gerber Technology (“Gerber”), consolidated since June 1, 2021, Neteven, since July 28, 2021, and Gemini CAD Systems (“Gemini”), since September 27, 2021. Lectra’s results before taking into account these acquisitions are provided in the “Lectra 2020 scope” paragraphs, in which comparisons between 2021 and 2020 are like-for-like.

Q4 2021

Q4 2021 revenues (125.6 million euros) were up 91% compared to Q4 2020.

EBITDA before non-recurring items totaled 21.8 million euros, up 66%, and the EBITDA margin before non- recurring items was 17.3%.

Income from operations before non-recurring items amounted to 14.8 million euros (10 million euros in Q4 2020) and net income totaled 11.4 million euros (+74%).

Lectra 2020 scope

Q4 confirmed the positive dynamic observed since the beginning of 2021.

Orders for perpetual software licenses, equipment and accompanying software, and non-recurring services (32.9 million euros) were up 16% compared to Q4 2020. The annual value of new software subscription orders amounted to 1.8 million euros (+57%).

Revenues (76.2 million euros) increased by 13% and income from operations before non-recurring items (11.9 million euros) increased by 5%.

2021

Acquisitions of Gerber, Neteven and Gemini

On February 8, 2021, Lectra announced having entered into a Memorandum of Understanding to acquire the entire capital and voting rights of the US-based company Gerber Technology. It then announced, on June 1, 2021, having finalized this acquisition.

The Company then finalized on July 28, 2021, the acquisition of the French company Neteven, and finally announced on September 6, 2021, the signature of an agreement to acquire the entire capital and voting rights of the Romanian company Gemini (the press releases related to these acquisitions are available on the website Lectra.com).

If Lectra had completed the acquisitions of Gerber, Neteven and Gemini on January 1, 2021, then the Group would have reported pro forma revenues of 468 million euros, pro forma EBITDA before non-recurring items of 73 million euros, and a pro forma EBITDA margin before non-recurring items of 15.6%.

Very strong growth in results in a more favorable environment, but one that remains heterogeneous and uncertain

While activity and results for the full year 2021 reflected a rebound in activity and investment decisions by customers, along with successful deployment of the Group’s new offers, the year remained marked by the consequences of the COVID-19 crisis, with periods of lockdowns and restrictions, often severe restrictions, alternating with periods of recovery, during the successive waves of the pandemic. The situation sustained a climate of uncertainty for the Group’s customers.

The crisis has also led to supply difficulties and rising costs of certain raw materials, which affected the Group’s manufacturing schedules and costs. It had a strongly negative impact on maritime transport, which caused delays in deliveries and sharply higher corresponding costs. In 2021, however, the Group has been able to limit the impact of these disruptions on its business and results.

Shortages of electronic components had a negative impact on production by the Group’s automotive customers and, consequently, on the revenue from consumables and parts.

Revenues of 2021 (387.6 million euros) were up 64%. EBITDA before non-recurring items (65.1 million euros) increased by 74%, and the EBITDA margin before non-recurring items was 16.8%.

Gerber (since June 1), Neteven (since July 28) and Gemini (since September 27) have contributed 106.6 million euros, 1.4 million euros and 0.5 million euros to revenues, respectively. Gerber’s contribution to EBITDA before non-recurring items was positive 13.3 million euros, Neteven’s and Gemini’s contribution was 0.2 million euros overall.

Consolidated income from operations before non-recurring items totaled 44.4 million euros. This included a 6-million-euro charge for amortization of intangible assets arising from the acquisitions of Gerber, Neteven and Gemini.

After a non-recurring net charge of 6.1 million euros for fees and other income and expense items relating to the acquisition of Gerber, income from operations amounted to 38.3 million euros.

Net income (28.2 million euros) was up 61%.

Free cash flow before non-recurring items came to 47.5 million euros (25.2 million euros in 2020). This sharp rise is attributable mainly to the improvement in business activity and higher income from operations. After disbursement of 8 million euros, in respect of fees and other related expenses in connection with the acquisition of Gerber, free cash-flow amounted to 39.5 million euros.

Balance sheet at December 31, 2021

Consolidated shareholders’ equity amounted to 400.8 million euros (192.2 million euros at December 31, 2020). This increase is explained mainly by the capital increase carried out for the purpose of the acquisition of Gerber in the total amount of 165.3 million euros.

At December 31, 2021, the Group’s net financial debt stood at 8.8 million euros, consisting in financial debt of 139.4 million euros and available cash of 130.6 million euros.

The working capital requirement at December 31, 2021 was a negative 31.5 million euros.

Lectra 2020 scope

Orders for perpetual software licenses, equipment and accompanying software, and non-recurring services (117.8 million euros) increased by 44%. The annual value of new software subscription orders (6.1 million euros) more than doubled compared to 2020.

Revenues (279.1 million euros) increased by 19% (+18% at actual exchange rates) compared to those of 2020, which had suffered the effects of the health crisis.

Revenues from perpetual software licenses, equipment and accompanying software, and non-recurring services (107.6 million euros) increased by 40%, those from recurring contracts (102.9 million euros) by 4% and those from consumables and parts (68.6 million euros) by 18%.

Income from operations before non-recurring items (40 million euros) increased by 61% compared to 2020 (+56% at actual exchange rates) and the operating margin before non-recurring items (14.3%) was up 3.8 percentage points (+3.4 percentage points at actual exchange rates).

2020-2022 STRATEGIC ROADMAP: SECOND PROGRESS REPORT

The Lectra 4.0 strategy was launched in 2017 with the aim of positioning the Group as a key Industry 4.0 player in its markets before 2030. It has been implemented to date through two consecutive strategic roadmaps.

The first roadmap, for 2017-2019, established the key fundamentals for the future of the Group, notably the successful integration into its new offers of the key technologies for Industry 4.0 (cloud computing, the Internet of Things, big data and artificial intelligence), the strengthening of the Executive Committee, the reorganization of subsidiaries into four main regions, and the launch of the first software offers in SaaS mode.

The second roadmap, for 2020-2022, was published in the financial report dated February 11, 2020. It is designed to enable Lectra to capture the full potential of its new offers for Industry 4.0, while delivering sustainable, profitable business growth.

Despite the consequences of the economic crisis caused by the COVID-19 pandemic, the objectives of the 2020-2022 strategic roadmap remain unchanged. The only adjustments to the original objectives are in the growth targets for the end of the three-year period – notably following the acquisition by Lectra of Gerber, Neteven, and Gemini.

The Lectra 4.0 strategy, and each of the main chapters in the strategic roadmap for 2020-2022, are summarized in the financial report at December 31, 2021, which is available on Lectra.com.

The financial objectives that the Group set itself for 2022 are provided in the “Outlook” chapter of this press release.

DIVIDEND AT €0.36 PER SHARE

The Board of Directors will propose to the Shareholders’ Meeting of April 29, 2022, the payment of a dividend at €0.36 per share in respect of fiscal year 2021.

OUTLOOK

While uncertainties persist regarding the evolution of the pandemic and its impacts on the macroeconomic environment (e.g., inflation, difficulties in the automotive industry, and transportation costs), and could continue to weigh on investment decisions by the Group’s customers, still the rebound in orders and in earnings recorded in 2021 have confirmed the relevance of Lectra’s strategy and the strength of its business model.

The acquisitions made in 2021, and particularly the acquisition of Gerber, give the Group a new dimension and open new perspectives.

At the same time, the new offers for Industry 4.0 are increasingly contributing to revenues and earnings.

Finally, the very strong balance sheet, with shareholders’ equity of 400 million euros and net financial debt held at 9 million euros at December 31, 2021, enables the Group to implement its long-term strategy in a serene manner.

Financial objectives for 2022

In the February 8, 2021, announcement of Lectra’s proposal to acquire Gerber, the Group reported on the 2022 financial objectives for the combined entity: returning to the level of combined revenue achieved by Lectra and Gerber in 2019 (482 million euros) and generating an EBITDA margin before non-recurring items in the range of 17% to 20% by adding the expected synergies to the operational performance of the two groups.

Lectra subsequently acquired Neteven and Gemini, the rebound in activity in 2021 was greater than the Group expected, and the dollar strengthened against the euro.

In light of the above, the Group has raised its objectives for 2022, with revenues in the range of 508 to 556 million euros (+ 31% to + 43% at actual exchange rates) and EBITDA before non-recurring items in the range of 92 to 104 million euros (+ 41% to + 60% at actual exchange rates).

These objectives were prepared on the basis of the closing exchange rates on December 31, 2021, and particularly $1.13 to the euro.

The Management Discussion and Analysis of Financial Conditions and Results of Operations and the financial statements for Q4 and the fiscal year 2021 are available on lectra.com. First quarter earnings for 2022 will be published on April 28, 2022. The Annual Shareholders’ Meeting will take place on April 29, 2022.

For companies that breathe life into our wardrobes, car interiors, furniture and more, Lectra crafts the premium technologies that facilitate the digital transformation of their industry. Lectra’s offer empowers brands, manufacturers and retailers from design to production, providing them with the market respect and peace of mind they deserve. Founded in 1973, the company reported revenues of 388 million euros in 2021 and is listed on Euronext (LSS).

In June 2021, Lectra acquired Gerber Technology, a USA-based company founded in 1968. Like Lectra, Gerber Technology develops software and automation solutions for fashion, automotive, furniture and other businesses across the globe.

For more information, please visit www.lectra.com.

Lectra – World Headquarters:

16–18, rue Chalgrin • 75016 Paris • France

Tel. +33 (0)1 53 64 42 00 www.lectra.com