Summary

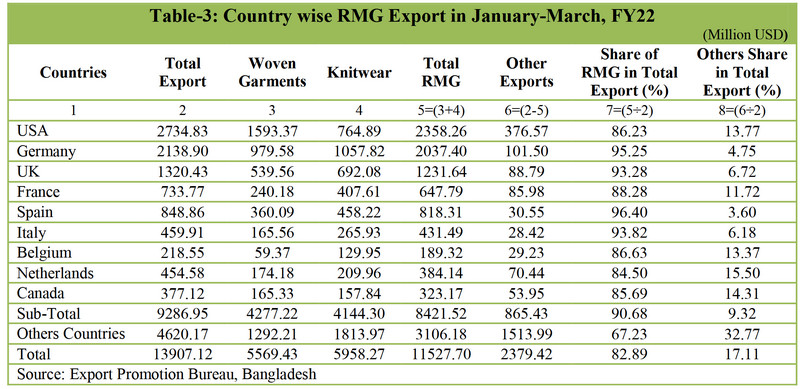

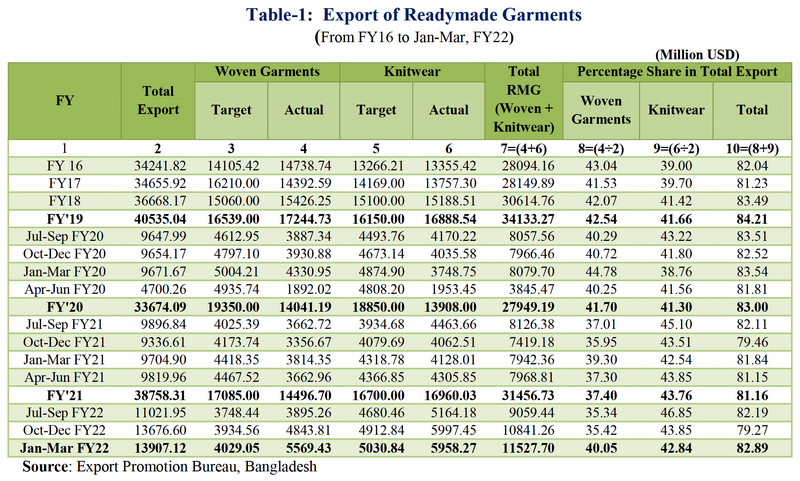

- Total export earnings from Readymade Garments (RMG) stood at USD 11527.70 million in January-March FY22 (Woven USD 5569.43 million and Knitwear USD 5958.27 million), which were 6.33 and 45.14 percent higher than that of the previous quarter and the same quarter of last year respectively supported by various government and Bangladesh Bank policy initiatives.

- RMG’s total export earnings in January-March FY22 were 27.24 percent higher than the quarterly target of USD 9059.89 million.

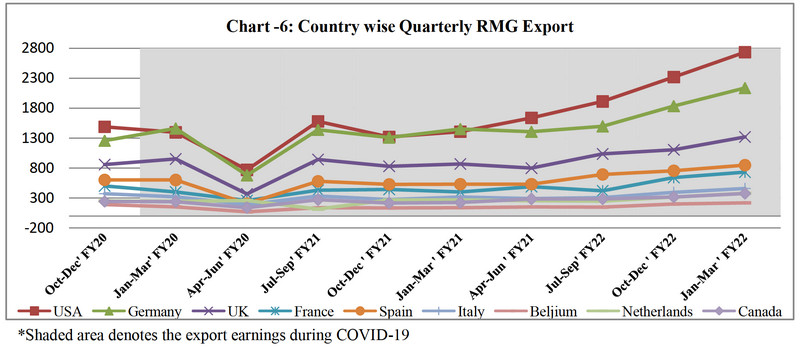

- The United States, Germany, the United Kingdom, Spain, France, Italy, the Netherlands, Canada, and Belgium were the top destinations for Bangladesh’s RMG exports in FY22.

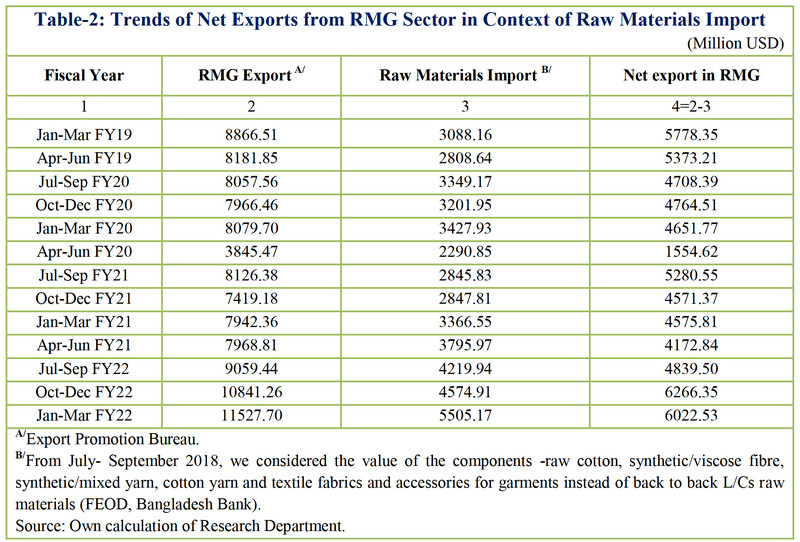

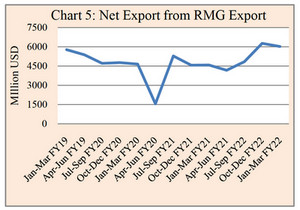

From these countries, Bangladesh earned USD 8421.52 million as RMG export earnings, accounting for 90.68 percent of total RMG exports. - In this quarter, RMGs net export (determined by subtracting RMG raw material import value from RMG export value) was USD 6022.53 million, or 52.24 percent of gross RMG export.

The Readymade Garments (RMG) sector has been playing a crucial role to accelerate the economic growth of Bangladesh through higher export earnings. Moreover, this sector is also creating a vast employment opportunities of the country, especially low-skilled, entry level jobs for young men and women.

The country’s RMG export earnings increased by 6.33 percent in the January-March FY22 quarter as compared to previous quarter. RMG’s quarterly export earnings also outperformed than that of the previous year’s corresponding quarter and the quarterly target by 45.14 percent and 27.24 percent respectively. This expansion was supported by an increase in apparel product shipments to the United States and European countries, as well as different government and central bank involvement in the Covid period.

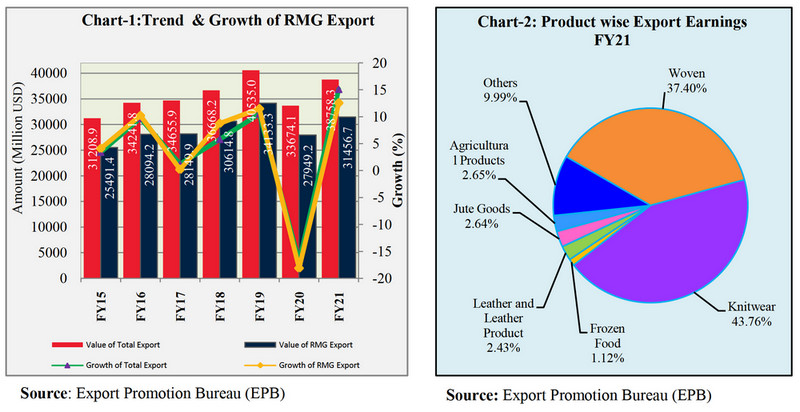

In FY21, the RMG sector contributed 7.66 percent to GDP. Bangladesh’s overall RMG export revenues are USD 31456.73 million, up 12.55 percent from the previous fiscal year (Chart-1). The contributions of RMG sector and non-RMG products to total export earnings in FY21 are shown in Chart-2.

Quarterly Performance of RMG: January-March FY22

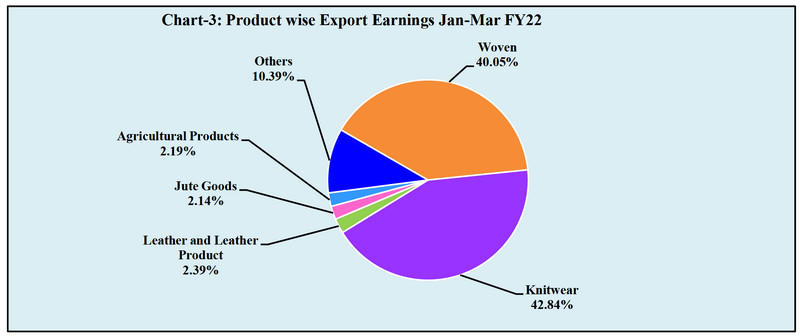

RMG’s export earnings stood at USD 11527.70 million during the third quarter of FY22. Due to an improvement in the COVID-19 situation, RMG’s export earnings were 27.24 percent higher than that of the quarterly target. Woven garments and knitwear contributed 40.05 percent and 42.84 percent to total export earnings during the period under review respectively (Table-1).

Besides, in this quarter, the contributions of non-RMG products to total exports earnings were as follows: leather and leather products (2.39 percent), agricultural products (2.19 percent), jute goods (2.14 percent), and other products (10.39 percent) (Chart 3).

Knitwear

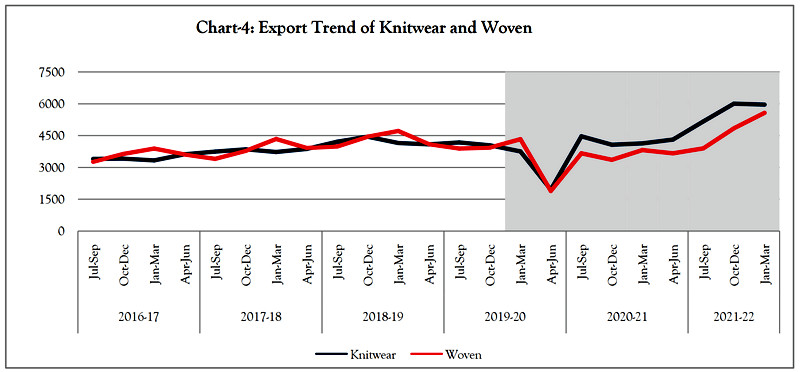

Despite of a significant increase in exports in the previous quarter, export earnings from knitwear fell slightly in January-March FY22, to USD 5958.27 million, which was 0.65 percent lower than the previous quarter but 44.34 percent higher than the same period of the previous year. Furthermore, knitwear exports were 18.43 percent greater than the target for the quarter under review (Table-1). Knitwear export earnings are displayed in Chart-4 on quarterly basis.

Woven Garments

The third quarter of FY22 showed a significant increase in woven garment export earnings, which totaled USD 5569.43 million, up 14.98 percent from the previous quarter and 46.01 percent more than the same quarterly the previous year. Exports of woven garments were 38.23 percent higher than the quarterly export target (Table-1). Chart-4 shows quarterly export earnings from woven garments.

(Million USD). * Shaded area denotes the export earnings during Covid-19

Import of Raw Materials and Net Exports

Import of Raw Materials and Net Exports

The import value of raw materials (raw cotton, synthetic/viscose fibre, synthetic/mixed yarn, cotton yarn, and textile fabrics and accessories for garments) was USD 5505.17 million in January- March FY22, accounting for 47.76 percent of total RMG export earnings. As a result, net exports from this sector totaled USD 6022.53 million in the third quarter, lower of 3.89 percent from the previous quarter but higher of 31.62 percent from the same period the previous year. The high cost of imported raw materials caused a drop in net exports for the quarter. The import of raw materials and net export based on L/C statement (FEOD) from FY19 (January-March) to FY22 (January- March) are shown in chart-5 and table 2.

Destination of RMG Exports

The main destinations of Bangladesh’s RMG exports are the USA, Germany, UK, Spain, France, Italy, Netherlands, Canada, and Belgium (Chart-6). During January-March of FY22, total export earnings from these nine countries stood at USD 9286.95 million; of which 90.68 percent or USD 8421.52 million was earned from the RMG (woven 46.06 percent and knitwear 44.62 percent) export (Table-3). During the quarter under report, RMG export earnings from these nine countries increased by 5.85 percent as compared to that of the previous quarter and this was 50.41 percent higher than that of the corresponding quarter of the preceding fiscal year.

Recent Measures Taken by the Government, Bangladesh Bank and Other Stakeholders

The government has taken a number of measures along with available finance to increase RMG production and export. Following funds are important: Pre-shipment Credit: To continue the export activities of export oriented RMG industries amid the Corona pandemic, Bangladesh Bank has formed a refinance fund worth of BDT 50.00 billion. RMG entrepreneurs can take loans from this fund through banks at 6 percent rate of interest (BRPD Circular No 9, Date 13 April, 2020). Recently, for the betterment of economic growth in export sector, BB reduced the interest rate on this refinance fund from 6 percent to 5 percent at receiver level and 3 percent to 2 percent at bank level (BRPD Circular No-26, Date 26 April, 2021). Bangladesh Bank has expanded the tenure of loan facilities for entrepreneurs from 01 year to 03 years under this refinance scheme. Entrepreneurs can avail the loan more than one times within the mentioned period (BRPD circular no: 44, Date 30 September 2021).

Incentives for Export Expansion: During the FY22, to encourage the country’s export trade, export subsidies or cash incentives have been given for some export items to be effective from 1 July 2021 to 30 June 2022. Among them, 4 percent cash incentive has been fixed for export oriented garments sector, small & medium industry of garments sector and to help expanding the new items/ new market garments sector (excluded USA, Canada, UAE). Inspite of existing 4 percent cash incentive, additional 2 percent has been given as support for the exporters of garments sector of EURO zones. Morever, 1 percent special cash incentive has been fixed for RMG sector (FE Circular No-29, Date 20 September, 2021).

Extended Facilities for Trade Transactions: To facilitate smooth transition in the external trade activities of the country, it has been decided as follows: a) The usage period for industrial raw material imports, including back-to-back imports under supplier or buyer credit, is extendable up to 270 days under the Guideline for Foreign Exchange Transactions (GFET)-2018, Vol.-1. (b) The Export Development Fund (EDF) limit for individual BTMA and BGMEA member mills will be USD 30 million rather than USD 25 million, and the EDF loan will be extended from 90 days to 270 days. These supports will be valid for the respective transactions until June 30, 2022 (FE Circular No-01, Date January 6, 2022).

Conclusion

The performance of Bangladesh’s external sector is largely dependent on RMG exports. This industry (woven and knitwear) accounted for 82.89 percent of total exports and 85.35 percent of manufactured items shipped in January-March quarter of FY22. A variety of supportive measures, such as ensuring the supply of raw materials at reduced prices, reducing the lead time of production, ensuring a variety of low-cost refinancing schemes, improving the ease of doing business, and diversifying products instead of basic and low-priced products, etc., must be articulated in order to maintain the growth momentum of this sector.

(Source: Research Department, External Economics Wing, Bangladesh Bank)

Import of Raw Materials and Net Exports

Import of Raw Materials and Net Exports