Arvind Limited, one of the largest integrated textile and branded apparel players recorded 21% growth in revenue and 48 % growth in Profit after tax for the full year ending 31st March 2012. Revenue for the year stood at Rs. 4925 crores as against Rs. 4085 crores for the previous year. Net Profit After tax from ordinary activity stood at Rs. 245 crores compared to Rs. 165 crores in the previous financial year. At the operating level, consolidated EBIDTA for the year ended 31st March 2012, increased by 14% at Rs.602 crores as against Rs. 529 crores for the previous year ended on 31st March 2011. The Board of Directors has recommended dividend of 10% for the year 2011-12.

-

- Arvind is one of the largest producers of denim in the world.

-

- With market share of over 13%, Arvind is the largest player in domestic market in India.

-

- Arvind has about 50% market share with leading national & international brands in India.

Growth Strategy :

-

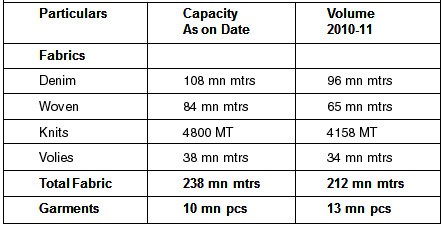

- Grow denim business by ~10% p.a

-

- Planned capacity by 2015 140 M

Wovens :

With over 72 Million fabric manufacturing capacity, Arvind is the largest producers of shirting & Khaki fabrics in the country

Growth Strategy :

-

- Grow Wovens capacity by 15% p.a

-

- Planned capacity by 2015 – 100 M

Denim :

GAP

Miss Sixty

Diesel

Armani Exchange

Ann Taylor

Hugo Boss

Polo Ralph

Jack & Jones

Levi’s

Lee

Wrangler

Zara

Esprit

H & M

Quick silver

Woven :

GAP

Banana Republic

Brooks Brothers

Ann Taylor

Hugo Boss

Calvin Klein

Polo Ralph

Eddie Bauer

Express

J Crew

Louis Phillip

Van Heusen

Arrow

Color Plus

Esprit

Paul Smith

Park Avenue

Color plus

The growth in Revenue is driven by 44 % growth in Brands & Retail business and significant increases in prices of fabrics caused by very high cotton prices. Textile business grew by 15%. Within Textiles, Denim grew by 18% and Wovens grew by 11%. However there was marginal drop in EBIDTA margin to 12.2% for the year as against 13% for the previous year as there was drop in operating margins in Brands & Retail business as Company had to absorb part of higher inventory cost.

The consolidated revenue for the quarter ended 31st March 2012, is up by 6% at Rs. 1278 crores as against Rs.1202 crores in the corresponding quarter of the previous year.

Commenting on the results as well as outlook of the Company, Mr. Jayesh Shah, Director & Chief Financial Officer said: “The FY 2011-12 was extremely challenging year for Arvind. The year was characterized by global slowdown, weak retail demand at home, high volatility in cotton prices and foreign exchange and higher interest cost. It is satisfying to note that in the backdrop of such a challenging environment, we have closed the FY 2011-12 with 48% growth in Net Profit.

Domestic (Denim)

1. Raymonds 2. KG Denim 3. LNJ Denim

4. MalwaIndustries 5. Bhaskar Industries

Domestic (Woven)

1. Bombay Rayon Fashions

2. Nahar 3. Alok

Global (Denim)

1. Travex-S. America 2. Artistic -Pakistan

3. Cone-N.America 4. Isko-Turkey

5. Orta-Turkey 6. Atlantic Denim-Thailand

Global (Woven)

1. Luthai-China 2. Smart Shirt-China

The Board has recommended the dividend @ 10%. Hitherto Company was conserving cash for reduction of the debt. The broad-based portfolio of businesses has brought predictability in our earnings. Further, Company is likely to be cash surplus in coming few years after meeting all our growth requirements. This has led the Board to bring back Company on the dividend list after gap of six years.”