14th July, 2021:

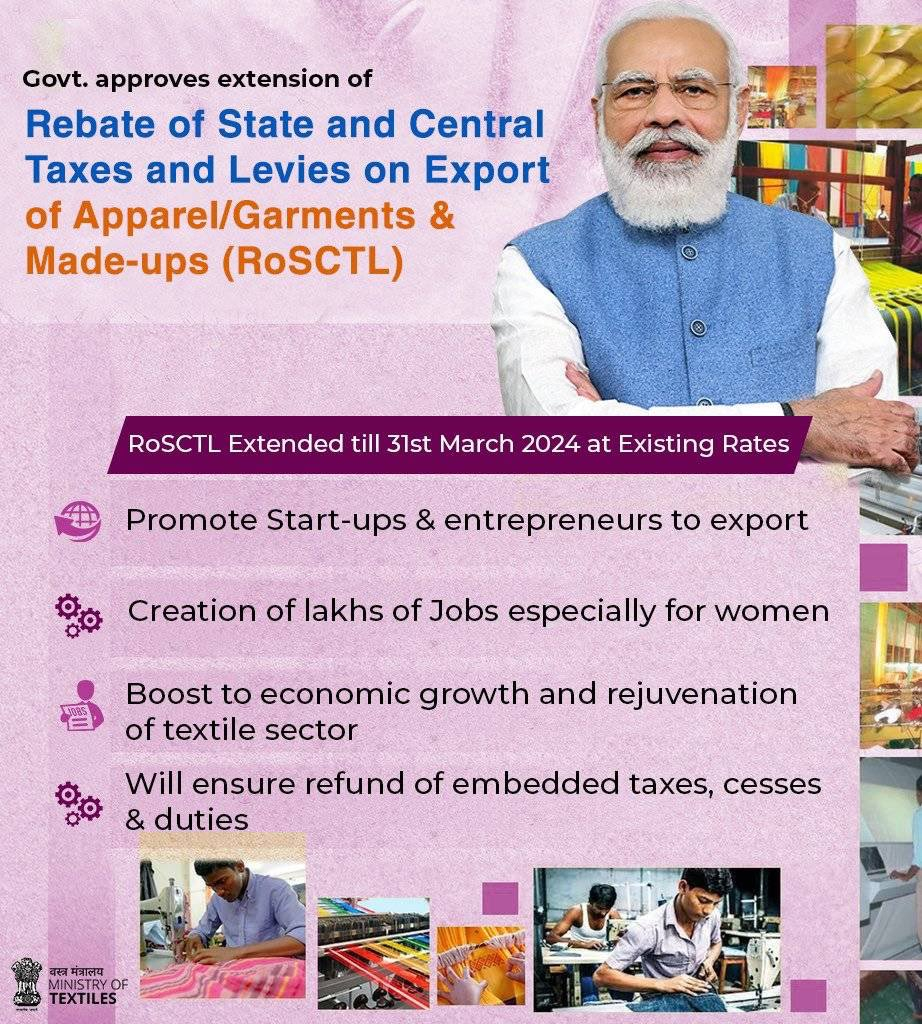

Government approves continuation of Rebate of State and Central taxes and Levies (RoSCTL) on Export of Apparel/Garments and Made-ups

- Continuation of RoSCTL Scheme would boost export in global markets; make Indian products globally competitive

- Gives much needed fillip to the envisioned goal of “Aatmanirbhar Bharat”

- Provide a level playing field to Indian Textiles’ exporters

- This scheme is likely to provide direct and indirect employment to lakhs of people, especially women

The Union Cabinet chaired by the Prime Minister, Shri Narendra Modi has given its approval for continuation of Rebate of State and Central taxes and Levies (RoSCTL) with the same rates as notified by Ministry of Textiles vide Notification dated 8th march 2019; w.e.f 1st January 2021 on exports of Apparel/Garments (Chapters-61 & 62) and Made-ups (Chapter-63) in exclusion from Remission of Duties and Taxes on Exported Products (RoDTEP) scheme for these chapters. The scheme will continue till 31st March 2024.

The other Textiles products (excluding Chapters-61, 62 & 63) which are not covered under the RoSCTL shall be eligible to avail the benefits, if any, under RoDTEP along with other products as finalised by Department of Commerce from the dates which shall be notified in this regard.

The Scheme shall be implemented by the Department of Revenue with end to end digitization for issuance of transferrable Duty Credit Scrip, which will be maintained in an electronic ledger in the Customs system. Revised guidelines for continuation and implementation of the RoSCTL scheme shall be prepared by the Ministry of Textiles in consultation with the Department of Revenue with necessary flexibilities to fine-tune the operational details, implementation modalities and scheduling etc.

Continuation of RoSCTL for Apparel/Garments (Chapter-61 & 62) and Made-ups (Chapter-63) is expected to make these products globally competitive by rebating all embedded taxes/levies which are currently not being rebated under any other mechanism.

Concept of Tax Refund for Exported Products

It is a globally accepted principle that taxes and duties should not be exported, to enable a level playing field in the international market for the exporters. This implies that all taxes and levies borne on the products which are exported should be either exempted or refunded to the exporters. This is called zero rating of the exports. In addition, to import duties and GST which are generally refunded, there are various other taxes/duties that are levied by Central, State and Local Government which are not refunded to the exporters. These taxes and levies get embedded in the price of the ultimate product being exported. Such embedded taxes and levies increase the price of Indian Apparel and Made-ups and make it difficult for them to compete in the international market.

Following taxes and levies are not refunded and are part of embedded taxes:

- State Value Added Tax on fuel used for transportation of input, generation of power and for the farm sector.

- Mandi Tax

- Duty on electricity charges

- Stamp duty on export documents

- GST paid on input such as pesticides, fertilizers

- GST paid on purchases from unregistered dealers etc.

Apparel and Made-up sector are highly labour intensive sector. They employ a large number of people especially women. It has been empirically established that an investment of Rs. 1 crore in manufacturing of apparel, garment and made-ups result in employment of 70 people. So there is a need to remove the disability being faced by this industry in the interest of providing employment opportunities to the people.

Realizing the importance of refund of embedded taxes and duties, the Ministry of Textiles first launched a scheme by the name of Rebate of State Levies (ROSL) in 2016. In this scheme the exporters of apparel, garment and made-ups were refunded embedded taxes and levies through the budget of the Ministry of Textiles. In 2019, the Ministry of Textiles notified a new scheme by the name Rebate of State and Central Taxes and Levies (RoSCTL) scheme for export garment and made-ups segments of textile industry covered in chapter 61, 62 and 63 of Drawback lines. Under this scheme the exporters are issued a Duty Credit Scrip for the value of embedded taxes and levies contained in the exported product. Exporters can use this SCRIP to pay basic Customs duty for the import of equipment, machinery or any other input. These SCRIPS are tradable so if the exporter does not need this for his personal use, he can transfer the same to any other importer.

Subsequently, the Department of Commerce has got Cabinet approval to launch a similar scheme RoDTEP for all other products which are exported excluding garment and made-ups segment of textiles. RoSCTL was launched in March, 2019 and had barely worked for a year before the pandemic set in. It has been felt that there is a need to provide some stable policy regime for the exporters. In the textile industry, buyer places long term orders and exporters have to chalk out their activities well in advance, it is important that the policy regime regarding export for these products should be stable. Keeping in view the same, the Ministry of Textiles has decided to continue the scheme of RoSCTL upto 31st March, 2024 independently as a separate scheme for apparel/garment and made-ups in the chapter 61, 62 and 63 of Duty drawback lines.

It is anticipated that the continuation of RoSCTL scheme is likely to help apparel, garment and made ups segment by way of additional investment and give direct and indirect employment to lakhs and lakhs of persons especially women.