Indian Textile Industry Poised for Growth, Says TEXPROCIL Chairman

Mumbai – The Indian textile and clothing sector is at a pivotal juncture, with recent global trade developments signaling both unprecedented opportunities and significant challenges, according to Vijay Agarwal, Chairman of the Cotton Textiles Export Promotion Council (TEXPROCIL). In a rapidly evolving global trade landscape marked by geopolitical shifts and economic realignments, the industry’s resilience and adaptability are being put to the test, with new agreements like the India–UK Comprehensive Economic and Trade Agreement (CETA) and ongoing engagements under the India–Japan CEPA offering pathways to growth, while proposed U.S. tariffs pose a looming threat.

Mumbai – The Indian textile and clothing sector is at a pivotal juncture, with recent global trade developments signaling both unprecedented opportunities and significant challenges, according to Vijay Agarwal, Chairman of the Cotton Textiles Export Promotion Council (TEXPROCIL). In a rapidly evolving global trade landscape marked by geopolitical shifts and economic realignments, the industry’s resilience and adaptability are being put to the test, with new agreements like the India–UK Comprehensive Economic and Trade Agreement (CETA) and ongoing engagements under the India–Japan CEPA offering pathways to growth, while proposed U.S. tariffs pose a looming threat.

The signing of the India–UK CETA, driven by the visionary leadership of Prime Minister Narendra Modi, marks a historic milestone for India’s textile industry. This landmark agreement grants zero-duty market access for 99% of Indian exports, encompassing 1,143 tariff lines in textiles and clothing. For Indian exporters, who have long faced a duty disadvantage compared to competitors like Bangladesh, Pakistan, and Cambodia, this levels the playing field in the UK market. The agreement is expected to boost India’s market share from its current 6.1% to an estimated 10–12% within three years, significantly enhancing export revenues and stimulating growth in key production hubs such as Tirupur, Surat, Ludhiana, Bhadohi, and Moradabad. The deal is set to benefit labor-intensive sectors, drive demand for value-added products, and encourage investments in design, technology, and compliance, positioning India for long-term strategic engagement with the UK.

However, even as the UK agreement opens new doors, the Indian textile industry faces a significant challenge in its largest export market, the United States. The recent announcement by President Trump of punitive tariffs of up to 25% on Indian textiles and garments, effective August 1, 2025, has raised alarm across the sector. If implemented, these tariffs could erode the competitiveness of Indian products, leading to order cancellations, stockpiling, and reduced retail demand. The impact would be particularly severe in cotton-rich categories like bed linen, apparel basics, and towels, where India has historically held a strong position. Given the labor-intensive nature of the industry, such tariffs threaten jobs, micro, small, and medium enterprises (MSMEs), and the broader textile value chain. Agarwal emphasized the urgent need for the Government of India to engage diplomatically with the U.S. administration to seek sector-specific exemptions, phased implementation, or relief measures to safeguard India’s role in ensuring supply chain resilience.

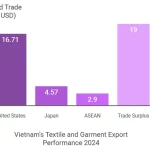

On a parallel front, recent engagements under the India–Japan Comprehensive Economic Partnership Agreement (CEPA) have highlighted untapped potential in the Japanese market. During a visit to Japan from July 14–17, 2025, led by Union Minister of Textiles Giriraj Singh, TEXPROCIL representatives, including Agarwal, participated in the 16th India Trend Fair in Tokyo and held discussions with major Japanese textile companies such as Fast Retailing (UNIQLO), YKK, and Toray Industries. With Japan’s textile imports valued at over USD 30 billion annually, India’s current share of just 1.2% underscores significant room for growth. Japanese buyers are increasingly seeking sustainable, scalable, and high-quality sourcing partners, and India is well-positioned to meet this demand by deepening supply partnerships, enhancing product innovation, and improving compliance standards, particularly in home textiles, made-ups, and functional fabrics.

To address the evolving global trade landscape, TEXPROCIL hosted a webinar on July 23, 2025, titled “Trade Deals: Navigating India’s Global Negotiations Landscape.” The session, anchored around the book “Strategies in GATT and WTO Negotiations” by trade expert Abhijit Das, featured a distinguished panel including former Ambassador V. S. Seshadri, former Indian Ambassador to the WTO J. S. Deepak, and Ajay Srivastava, founder of the Global Trade Research Initiative. Moderated by TEXPROCIL Executive Director Siddhartha Rajagopal, the discussion provided critical insights into India’s negotiation strategies and the implications of free trade agreements (FTAs) for the textile industry. The webinar offered TEXPROCIL members a roadmap to align their operations with emerging trade scenarios, tariff regimes, and regulatory expectations.

On the sustainability front, the Kasturi Cotton Bharat initiative continues to gain traction, with growing international interest in India’s regenerative cotton ecosystem. A recent meeting with Materra (UK) explored co-branding opportunities, while domestic demand for Kasturi BCI-compliant yarn has surged, with procurement projections exceeding 13.78 lakh kilograms, driven by major Indian retailers. This underscores the need to strengthen traceability, certification, and farmer support systems to position India’s cotton as a globally trusted brand.

As the Indian textile industry navigates this complex landscape of opportunities and challenges, Agarwal urged stakeholders to remain agile, quality-focused, and sustainability-driven. He encouraged exporters to seize new market opportunities, invest in technology and design, and forge stronger partnerships across the value chain. TEXPROCIL remains committed to supporting the industry through policy advocacy, industry dialogue, and market development initiatives, with the goal of reinforcing India’s leadership in the global textile market while safeguarding the interests of producers, workers, and exporters.