Blazer is probably the most difficult attire to produce, compared to other garments because of its fit specifications, SMV and the number of operations. Bangladesh is especially known as a top-class knit and denim manufacturers in the world. To grab the market, fighting with world suit dominator country China, Bangladesh has now leaped forward to make a presence in the global mass production of suits in a significantly short period and is presently fulfilling 12-15% of the global demand of suits, formal jackets and blazers. Not only for export purposes, but this country has a big potential value in the local fashion market also which generates more revenues every fiscal year.

Local fashion houses

Competing with world-famous brands, the country’s fashion houses are also working relentlessly to diversify blazer wear. Monochromatic suits go all the time along with semi suit style blazers. However, the demand for stripes and a small check is higher. The wrinkle-free woolen cloth is best for making blazers.

There are not many differences in the design of men’s or women’s blazers accept cutting. Slim fit fashion is going on in blazer fashion now. Blazers with two or three buttons are running all the time. However, many fashionable people are also wearing one-button blazers. The back two slits are being used in today’s fashion with a round shape at back.

In our country, heavy winter comes for a very short time. So during this period, young people don’t like to wrap themselves from head to toe in winter clothes. Now they mostly prefer such a suit that will be adapted to both formal and casual environments. Yellow, Sailor, Smartex, Cats Eye, Infinity, Ecstasy, Aarong and many more houses have brought catchy products in this winter.

Domestic business

Traders say the domestic market of readymade blazers is expanding due to increasing fashion-awareness, competitive prices and the purchasing power of people from different socio-economic classes. In Bangladesh, many blazer-making hubs meet up with local customer’s demands throughout the year and Keraniganj is one of them.

According to the Keraniganj Garments Traders and Shop Owners’ Cooperative Association, currently, local demand for readymade blazers stands approximately at 20 lakh pieces yearly, which is worth Tk 300 crore.

Bangladesh has now leaped forward to make a presence in the global mass production of suits in a significantly short period and is presently fulfilling 12-15% of the global demand of suits, formal jackets and blazers

Of this quantity, Keraniganj garments hub supplies about 16 lakh pieces worth Tk 240 crore, amounting to 80% of the total readymade blazer sales. The rest of the blazers are produced by the other local companies, located across the country.

Manufacturers told to media the local production of readymade blazers doubled over the last five years as almost 50% of people love to wear readymade ones. Generally, lower and middle-income people depend on this kind of hub, anyone can purchase at reasonable prices which is not available from fashion houses.

The garments hub has at least 500 factories that employed 6,000 workers that produce specialized blazers. They sell ready-made blazers throughout the year, but sales shoot up in winter. Although Covid created a barrier a few months ago to sell products, local sellers expect to sell better in the coming winter as we are overcoming the pandemic gradually.

Suit export industry of Bangladesh is booming

Bangladesh seems to be a promising exporter in terms of suit business. Bangladeshi factories are keeping footmarks in suit making world for a few years. Who are invested 10 years back in this track, now they are doing well. If we look back a few years prior, there were only 1-2 factories who made suits and blazers to export.

Presently 10-12 factories along with Energypac Fashions, FCI BD, Aptech, JIC Suit, Newage Group, Ha-Meem Group, East-West, Interlink Dresses, Ananta Group, etc. are working hard to grab the western market although the number is poor yet. Many Chinese companies are showing keen interest to invest here and they are establishing a plant in the economic zones especially.

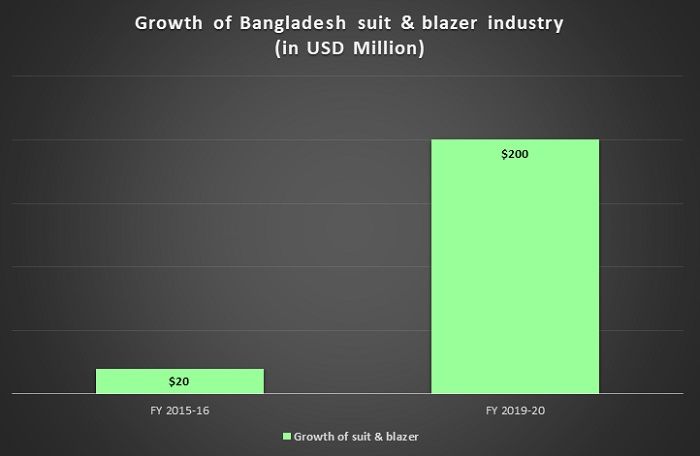

Europe, the USA, Japan, Korea are the major export destinations for Bangladesh. Kaiser, OVS, Otto, Camel Active, Calamar, Dressman, Espirit, Karstadt, Canda, Walmart, H&M, M&S, C&A, Calvin Klein, Garry Weber, Jack & Jones, Zara etc. brands are buying much from Bangladesh, exporters said. Bangladesh’s blazer industry now exports $200 million worth of products, up from about $20 million even 3-4 years ago.

The price of 3 dozen knit t-shirt or 1 dozen knit polo-shirt is equal to one piece of blazer. The retailers pay between $15 and $60 for a piece of suit whereas sometimes a dozen of T-shirts and polo-shirts from Bangladesh are sold at $20-30. Currently, Bangladesh dominates 15% share in suit export, but due to Covid-19 order quantity is decreased up to 40%.

| Leading suit maker in Bangladesh | Production/month (pcs) |

| Energypac Fashions | 6 lakh |

| FCI BD Group | 6.5 lakh |

| Aptech Group | 3 lakh |

| JIC Suit Ltd | 2 lakh |

| Newage Group | 1 lakh |

| Interlink Dresses | 60,000 |

| Ananta Group | 1 lakh |

| East-West Industrial Park | 7 lakh |

Many young entrepreneurs and investors are encouraged to set up suit plant. Ananta Group manufactures 1 lakh pcs suits per month in AEPZ.

Investing US$ 2 million and manufacturing formal and casual shirts for H&M and C&A, New Age Group has set up 46 sewing lines for stitching suits, both blazers and trousers, along with casual jackets for women. The Group employs 1,200 workers and has a production capacity of 1 lakh pcs/month and plans its capacity up to 1.5 lakh pcs/month by 2021. East West Industrial Park’s overseas sales have been climbing 20% every year.

Md. Nazmul Huda, Team Leader (Marketing & Merchandising, Kaiser Account) of Energypac Fashions Ltd said, “The suit industry is a specialized one. Although Bangladesh has buyers and technologies, it needs more time to be a major producer of suits. Along with convincing new buyers is also difficult as Bangladesh is not known widely for suits.”

“It’s not possible to receive $20 from a T-shirt but it’s possible to get more than $20 from a suit. Energypac is currently producing 6 lakh pcs attires per month and has 38 lines with three units, he added.”

Challenges and scope

As China gradually wraps up its business because of the rising labor cost, the door of opportunity is opening up and mounting pressure on competing countries such as Bangladesh, Vietnam, or Cambodia. However, in the geographical context, Cambodia and Vietnam are showing a lot of power in the suit industry.

Although Nice Denim, Mahmud Denims, Shasha, Envoy, Amber, NZ, Aaron, Pioneer give sound support in the woven section Bangladesh has to import blazer fabric and accessories totally, especially from China. Due to the lack of port capacity, it takes at least 15 days to release the goods, whereas China takes only 1-2 days. That’s why lead time increases.

Bangladesh is incomparable in terms of quality, has no claim from buyers. The country is lagged in fine quality thread making for blazers. Although some better companies, including coats, supply threads, but essential Ascolite thread has to import from Japan or Switzerland. While millers hope to boost export, Bangladesh’s growth could be stunted by ongoing weak backward linkages.

Many global brands source from China directly for many years due to the cheap price, but Covid-19 gives a lesson to learn is not to depend on a single source for raw material supplies. Now industry insiders think to shift towards decentralizing.

Tanzil Ahmed Tusher, Merchandiser of Aptech Caswier Ltd said, “High-value garments account for about 10% of total exports while shirts, trousers, jackets, t-shirts & sweaters account for 63% of the country’s total exports. To sustain in the market, we need to come out from the traditional low-cost products and emphasis to make suits, blazer.”

Need boosting

Experts have shared some important facts that have to be considered to boost the suit industry:

- Need smart negotiators so that we can develop a marketing strategy for grabbing more orders.

- The industry has to up-to-date with the new technology and innovations along with a strong R&D and design team.

- Govt should focus on making strong bond license, banking system, LC making, high tax issue, poor import and export system.

- Shortage of skilled manpower in this emerging sub-sector as a barrier. Need a proper training facility for the operators.

- Industry insiders should travel across the world to understand demand and fashion.

- Sick competition has to be stopped among the manufacturers.

Bangladesh is a beneficial hub to invest in suit business for entrepreneurs and existing manufacturers. This potential and more FOB earned sector can change the country’s position and can be able to take the country into its dream goal fast by 2021 if the concerned person works in coordination.

(Courtesy: Textile Today)