One of the most discussed topics these days – in the World of Conferences everywhere – is focused on China. All those connected with the Textile & Clothing (T&C)industry, the world over, want to hear from the top most US and European buyers and their agents the answer to the biggest and most difficult question as to whether China has had its day.

One of the most discussed topics these days – in the World of Conferences everywhere – is focused on China. All those connected with the Textile & Clothing (T&C)industry, the world over, want to hear from the top most US and European buyers and their agents the answer to the biggest and most difficult question as to whether China has had its day.

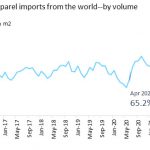

China’s exports of T&C in 2012 were of the order of 250 billion US$ contributing 12.4% to the total Chinese exports. During January to June of 2013, China has already recorded an export of 127.23 billion US$ in the T&C sector. According the China Chamber of Commerce for Import and Export of Textile and Apparel (CCCT), China’s textile industry suffered a setback in the EU market for the last two consecutive years, 2011 and 2012 because of the gradual growth of textile and clothing export in Southeast and South Asia. China’s T&C market share in EU market decreased from 42.5% in 2010 to 41% in 2011, further declined to 39.9% in 2012. In Japan also there was a decline from 77.1% in 2010 to 74.9% and 73.2% in 2011 and 2012, respectively. However, export from ASEAN to EU and Japan has registered a gradual increase of 8.3% and 13.7% respectively. Bangladesh has been able to increase its T&C exports to EU and Japan by 9.4% and 1.2%, respectively.China has been clothier to the world and has dominated manufacturing for the last 20 years. But rising labour costs, changes in logistics and altered economic realities are compelling buyers to promote other places that are potentially much more cost-competitive compared to China. The average hourly labour costs in China have risen from US$0.60 in 2002 to US$1.75 in 2013. In urban areas, the labour costs have risen to as high as US$2.85. Sourcing from Bangladesh, Mauritius or Colombia, therefore, has become economically more viable. Not only China but India is also now facing similar issues with the danger of it losing market share to smaller producers, like Haiti, El Salvador and Vietnam. There is a distinct market shift towards emerging markets and domestic proximity. Colombia, alongside other Latin American destinations and several Caribbean locations, has proved to be one of the major beneficiaries of the US buyers’ initiatives to go for rapid-response manufacturing facilities as it leads to several net cost advantages. Emerging markets can be more cost effective but have road blocks in terms of political & economic uncertainties.

Due to the challenges being faced by T&C industry, China now wants to focus on the domestic consumption and brand building. They want to reduce the share of apparel (rom 51 to 48%) and increase industrial textiles’ share from 20 to 25% by 2015. The industry aims to build 5 to 10 T&A brands having global influences and 100 T&A brands with high recognition in the global marketplace so that branded products account for at least 50% of total T&A exports. In order to achieve this they have realised the need for building a “greener” industry. The targets to be achieved by 2015 are: reduce energy consumption by 67.2%, water consumption by 83.2% and emission of pollutant per GDP output by 41%. China aims to give a big boost to recycling so as to be able to use 100% recycled textile fibers by 2015.

But all this will involve a major transition in the industry. In the process, a significant number of existing players may not even survive because their existence so far has been due to the abuse of cheap labour and the environmental issues besides liberal availability of bank finance. Apparently, it may be safely assumed that China has had its day – the day of comfort. What we are going to witness ahead is the day for China which could be perhaps a tough, rough and not so pleasant.