Denim jeans represent an estimated $60 billion global market for retailers, but recent cost-cutting measures (e.g., thinner fabrics, changes in fiber content, etc.) have caused significant performance issues and dissatisfaction among consumers. Ownership of denim jeans reached a peak in 2005/2006 due to the premium denim trend, which allowed shoppers to purchase higher quality jeans at multiple price-points. Following that peak, economic pressures and the fast-fashion movement compelled clothing retailers to sacrifice quality and cotton. As apparel prices began to rise at retail, the majority of shoppers indicated that they were paying more for inferior quality and began to scrutinize clothing by a different standard–and jeans were no exception.

Key Insights :

- Cost-cutting measures implemented throughout the supply chain have resulted in avoidable performance issues.

- Customer dissatisfaction is the highest vvhen synthetic fibers are substituted for cotton in denim jeans.

- Consumers are frustrated with jeans fading, shrinking, stretching, and falling apart.

- Issues with clothing durability have been noticed most in denim

Fierce Competition

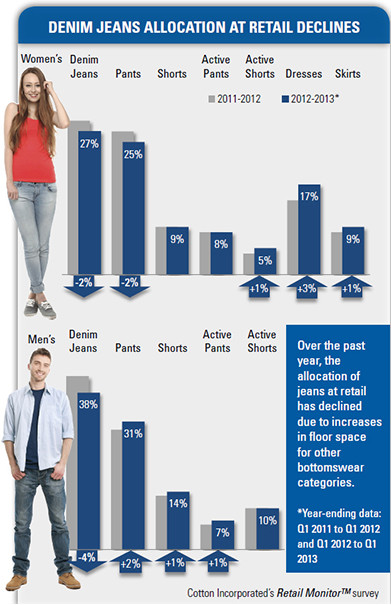

Denim jeans can be found in the wardrobes of 96% of U.S. consumers who, on average, own seven pairs. Despite high consumer favor, jeans have lost a significant amount of retail floor space to other bottomswear items like dresses and athletic pants, according to Cotton Incorporated’s Retail Monitor™ Survey. The popularity of women’s dresses has increased in the past five years, while athleticwear’s presence at retail has grown, in recent years, due to its popularity as a multifunctional apparel item among men and women. More than 9 out of 10 consumers report that they wear athletic apparel for activities other than exercise. Retailers across various channels have responded to consumer demand by adding more fashionable and functional athletic clothing to their product lines, thereby reducing available floor space for knit tops and jeans.

The competition that denim jeans are facing from other product categories is intensified by shoppers being disappointed about recent changes in the quality of fabric and fiber content of apparel products. The majority of consumers say that clothing purchases do not last as long (59%) and that the quality of clothing has declined from last year (52%). Almost three out of four apparel shoppers (72%) also say that clothing prices have increased since last year. Paying more for less does not meet consumers’ value expectations and Cotton Incorporated’s Customer Comment Research™ reveals that dissatisfaction with clothing quality is the highest for denim jean purchases.

Denim jeans accounted for nearly 30% of negative customer ratings-higher than any other apparel product studied. In fact, compared to all other clothing categories, customers were most likely to mention poor quality (25%), disappointment (28%), and returns made due to dissatisfaction (28%) in their denim jean reviews. Because consumers have more brand loyalty when purchasing jeans, many notice changes in jean quality and indicate feeling betrayed by their favorite brand.

Consumers have noticed and are dissatisfied that other fibers have been substituted for cotton in denim jeans and indicate that new fibers do not perform as well as cotton. More than 6 out of 10 (61%) consumers say they are bothered retailers would substitute synthetic fibers for cotton in their jeans. Analysis of denim jean customer reviews reveal that fading (23%), shrinking (22%), stretch recovery (19%), wear & tear (16%), and odor (10%) were the top performance issues.

Performance Issues

The performance issues that customers have experienced in recent denim jean offerings may be hurting the competitiveness and sales of jeans. Customer reviews of jeans purchases reveal that fading (23%), shrinking (22%), stretch recovery (19%), wear and tear (16%), and odor (10%) were the top performance issues. Many of these performance problems could have been avoided with proper textile processing, such as the use of better or correctly prepared dyes to avoid fading and heat-setting to avoid stretch recovery issues. Performance issues could be motivating consumers to postpone new jean purchases out of concerns about lower quality options. Nearly 6 in 10 consumers (58%, up significantly from 49% last year) say they buy new jeans for need-based reasons (i.e., their old jeans were worn out). While keeping costs low is important, customer dissatisfaction, hesitation about purchasing, and resolve never to shop at a retailer again because of quality concerns clearly outweigh any marginal savings.

Consumers are more than twice as likely to rate denim jeans negatively if they experience pilling, itching, or durability issues. While durability issues may be linked to improper textile processing, pilling and itching issues may be the result of blending synthetic fibers into jeans. The addition of non-traditional fibers, such as polyester, contribute to the most problematic jean textile issues and when consumers notice less cotton and more synthetic fibers in their jeans, negative ratings increase nearly four times. Consumers indicate that new fibers do not perform as well as cotton in their jeans and that they are getting less value for their money. These factors explain why more than 6 out of 10 consumers say they are bothered retailers would substitute synthetic fibers for cotton in their jeans.

Recovery Opportunities

With limited disposable income, today’s pragmatic shoppers are looking to make an investment in their clothing. When jeans fail to meet customers’ expectations, they may respond by purchasing other brands or apparel items. The success of the 2005/2006 premium denim trend, which contributed to significant increases in jean imports, sales, and consumer ownership, demonstrates that apparel shoppers desire better quality jeans and will pay more. Addressing common textile problems to resolve denim jean performance issues and providing the proven quality that cotton-rich jeans deliver will be essential to improve jeans sales and to ensure that jeans remain competitive with other apparel products.