The 2024 FESPA Party Night on Thursday 21 March 2024

The FESPA Party Night is the ultimate event for the industry to network, unwind and enjoy an evening of live entertainment, music, drinks and grea [...]

Avoid panic buying of cotton, says SIMA

Spiraling of cotton prices – avoid panic buying – SIMA

Coimbatore: The predominantly cotton based Indian textiles & clothing industry has been [...]

Industry Associations Joint Letter On The EU-Mercosur Agreement

Industry Associations' Joint Letter seeking rapid conclusion of the EU-Mercosur Agreement

Brussels – EURATEX and 22 industry associations sent a joi [...]

European Technical Textile Industry faces Tough Times

A diverse group of workers operating high-tech machinery in a textile factory, with raw materials being transformed into finished products, symboliz [...]

International Conference on Sustainability and Circularity

International Conference On Sustainability & Circularity: The New Challenges For The Textile Value Chain

Wednesday, 31st January 2024

Hotel The [...]

EURATEX Manifesto for Making the Industry Competitive

2024 is a Turning Point for the European Textiles and Clothing Industry

From 6 to 9 June 2024, European citizens will vote for a new European P [...]

Prolonged recession in the global textile value chain

Weakening demand, inflation, and geopolitics – major causes for prolonged recession in the global textile value chain – ITMF Chief

The textile [...]

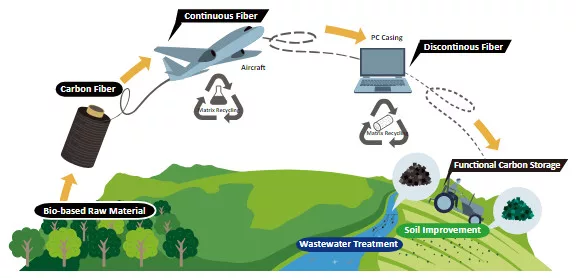

Toray Carbon Fiber Recycled from Boeing 787 Wing Production

Toray Carbon Fiber Recycled from Boeing 787 Wing Production Process Applied in Lenovo ThinkPad X1 Carbon Gen 12

Tokyo, Japan – Toray Industries, In [...]

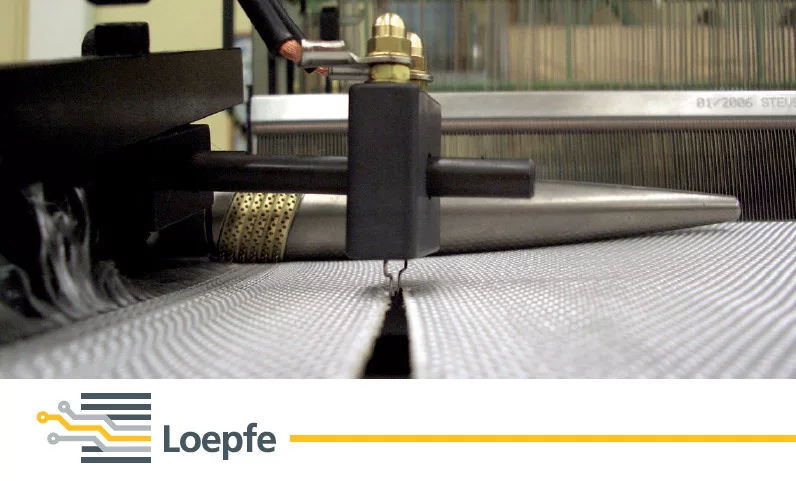

Thermal fabric cutting system

Thermal fabric cutting system - Weftmaster Loepfe's CUT-iT for airbag fabrics

WeftMaster CUT-iT for airbag fabrics. In case of the unexpected whi [...]

Hohenstein and Under Armour present test kit for textile microfibre shedding

For the test, the textiles are cut into round pieces and stirred by magnetic mixers in a glass of liquid. After this process, the fibers are filte [...]