November Apparel Shipments Sink: OTEXA

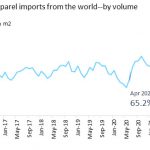

The latest data from the US Office of Textile and Apparel (OTEXA) reveals that US apparel import volumes fell sharply in November, representing the worst performance since the pandemic.

US apparel imports, according to the latest data from OTEXA for the month of November, fell by more than 30% in quantity from a year ago, and nearly 15% in value.

The data corresponds with figures from the National Retail Federation (NRF) which reveals that US ports handled 1.78m Twenty-Foot Equivalent Units (TEU), down 11.3% from October and down 15.8% from November 2021. It was the lowest total since 1.87m TEU in February 2021, which had been the only month in over two years to fall below 2m TEU.

The University of Delaware’s associate professor of fashion and apparel studies, Dr Sheng Lu, believes this is “a warning sign about a cooling US economy and fashion companies’ pessimistic near-term market outlook”.

For the month of November, OTEXA data shows US apparel imports were down 31.8% to 1,742 MM2 in volume terms. China remains the top apparel supplier to the US but the East Asian country saw shipment volumes drop by 0.3% during November 2022 compared with 3% year-on-year drop in November 2021.

Vietnam (251 MM2), Bangladesh (173 MM2), India (76 MM2) and Indonesia (79 MM2) completed the top five, respectively, in volume terms during November.

Lu believes the latest data reflects US fashion companies’ continuation to reduce their “China exposure” further, particularly to other Asian suppliers, led by Bangladesh, India, Indonesia, Vietnam, and Pakistan.

“Notably, only 31% of US apparel imports in quantity and about 19% in value came from China in November 2022, much lower than 38% and 24% in 2021. Notably, only 10% of US cotton apparel imports came from China in November 2022 due to the Uyghur Forced Labor Prevention Act (UFLPA),” Lu says.

Sourcing trends to watch out for

Lu sets out several US apparel sourcing trends that are worth watching, based on the latest OTEXA data.

“First, US apparel import volume fell sharply in November 2022, a warning sign about a cooling US economy and fashion companies’ pessimistic near-term market outlook. Notably, data shows that US apparel imports in November 2022 decreased by more than 30% in quantity and nearly 15% in value from a year ago. This was the worst performance since the pandemic.

“Second, the hiking sourcing costs began to ease due to weakened demand. The price index of US apparel imports stood at 106.3 (January 2019=100), slightly down from 106.4 a month ago. However, as the Russia-Ukraine war won’t end anytime soon and labour costs continue to rise in many garment-producing countries, fashion companies’ apparel sourcing costs are unlikely to drop substantially in 2023.

“Third, trade data suggests that US fashion companies are serious about expanding near-shoring. Notably, 17.1% of US apparel imports in quantity and 20.9% in value came from Western Hemisphere suppliers in November 2022, the highest share since 2019. Likewise, about 12.3% of US apparel imports in quantity and 13.9% in value came from members of the Central America Free Trade Agreement (CAFTA-DR) in November 2022, also the highest in the past five years.

“That being said, in the first ten months of 2022 (latest data available), only 67.3% of US apparel imports from CAFTA-DR claimed the preferential duty benefit, much lower than 74.2% in 2021. Previous studies show that US fashion companies often struggled with the insufficient textile supply within CAFTA-DR and the agreement’s restrictive rules of origin when sourcing from the region. Thus, we shall not expect US fashion companies to keep sourcing from CAFTA-DR without being able to save import duties in the long run. Meanwhile, it is important to note that US apparel imports from the Western Hemisphere typically peak in November and December due to seasonal factors.”

Summary of OTEXA’s apparel imports for November

- In value terms, China saw its share of US apparel imports drop by 2.1% in November to 18.8%. Imports amounted to US$1.18bn.

- Bangladesh saw its share increase by 1.1% in November. In value terms, US apparel imports amounted to $598m.

- Vietnam (0.5%), India (0.6%), Indonesia (0.6%), Cambodia (0.2%), Pakistan (0.4%) and Sri Lanka (0.1%), also saw their share of US apparel imports increase.

- Of the top ten, Indonesia experienced the highest growth in volume of US apparel imports in 2022 at 28.5%, followed by Bangladesh (26%) and India (20.5%).

- China retains the highest volume share of US imports in volume terms, at 34.8%, but this is down on last year by 3%.

- Negative growth in US apparel imports, in volume terms, was experienced by China (-0.3%), Mexico (-5.1%), and El Salvador (-8%) in 2022.

The Office of Textiles and Apparel (OTEXA) undertakes industry analysis, contributes to U.S. trade policy development, participates in trade negotiations and trade promotion, and addresses trade barriers. OTEXA works with other Department of Commerce units and U.S. agencies in developing a public policy environment that advances U.S. competitiveness at home and abroad.

US Imports of Textiles and Apparels in November 2022

| wdt_ID | Category | Description | Units | Sum of 2021 | Sum of YE Current Month/'21 | Sum of YE Current Month/'22 | YE % Change |

|---|---|---|---|---|---|---|---|

| 1 | 0 | TOTAL TEXTILE AND APPAREL IMPORTS (MFA) | $ | 7,42 | 6,99 | 10,15 | 45,30 |

| 2 | 1 | TOTAL APPAREL IMPORTS (MFA) | $ | 7,15 | 6,72 | 9,85 | 46,52 |

| 3 | 2 | TOTAL NON-APPAREL IMPORTS (MFA) | $ | 272,32 | 267,26 | 306,52 | 14,69 |

| 4 | 11 | TOTAL YARN IMPORTS | $ | 4,54 | 4,54 | 21,68 | 377,52 |

| 5 | 12 | TOTAL FABRIC IMPORTS | $ | 7,01 | 7,34 | 5,60 | -23,82 |