The European market for home decoration and home textile (HDHT) products is growing. A considerable share of Europe’s HDHT imports comes from developing countries. Because European importers generally distribute your products across the continent, you should focus on segments rather than specific countries. Opportunities are particularly good in the mid to high-end markets, where you avoid competition with low-cost mass-producing suppliers. If you can make your products stand out by adding unique value, there is potential across the sector.

What makes Europe an interesting market for home decoration and home textiles?

European imports of HDHT products are steadily increasing. Although the impact of the COVID-19 crisis may vary across product groups and countries, reported increases in HDHT sales across Europe are encouraging. Developing countries play a key role in the European HDHT import market. While mass production from countries like China dominates the low-end market, the mid- to high-end markets offer you good opportunities.

The impact of COVID-19 on the European HDHT market

The coronavirus pandemic and the measures taken against it worldwide are having a large impact on international trade and the European market for many products and services, including HDHT. Please note that the below analysis is based on the statistics that are currently available, which refer to the 2015–2019 period. Therefore, the concrete impact of the pandemic on the European market and global supply chains has not been taken into account in this report.

The pandemic is expected to affect demand for HDHT products, although the exact effect may differ per product group. In general, the pandemic is causing low consumer confidence. Besides preoccupation with their health, consumers also worry about whether they will have work, and to what extent their livelihood will be under pressure. This obviously does not stimulate sales. The distribution chain in the sector is also severely affected, as lots of brick-and-mortar retail has had to close (being ‘non-essential’) and some may not survive the crisis financially.

Several existing trends in the sector may well be supported or even accelerated by the COVID-19 pandemic, such as the increasing importance of wellness and sustainability. As people spend more time at home, they may invest in (affordable) HDHT products that help them make the most of the situation and the space they have at their disposal. While budgets for indulgent luxury purchases may be limited, product groups that could potentially benefit from the crisis include home office furniture, garden furniture, flexible and multifunctional items, dinnerware and cookware.

The exact effects of the crisis on the HDHT market may differ considerably per country, as economic consequences and restrictions vary. A hopeful sign for the sector is that across Europe (and even globally), an increase in demand for HDHT products has been reported. For example, the Dutch HDHT retail sector realised an impressive 11% year-on-year sales increase in the first six months of 2020. Although such a surge in demand is unlikely to continue long term, it provides the industry with a much needed boost in these uncertain circumstances.

In response to a survey among participants and visitors to the Maison & Objet’s Digital Fair in September 2020, approximately 90% of HDHT retailers, design houses and manufacturers say that although the COVID-19 pandemic will weaken their business, their company will survive.

Europe relies on imports to meet its demand for HDHT products

Since 2016, European production of HDHT products has been fluctuating slightly around €185 billion. At the same time, consumption is fairly stable at about €200 billion.

Branding and services for the European HDHT market generally take place within Europe. A lot of production, however, has structurally been moved to lower-cost countries.

European HDHT imports are growing steadily

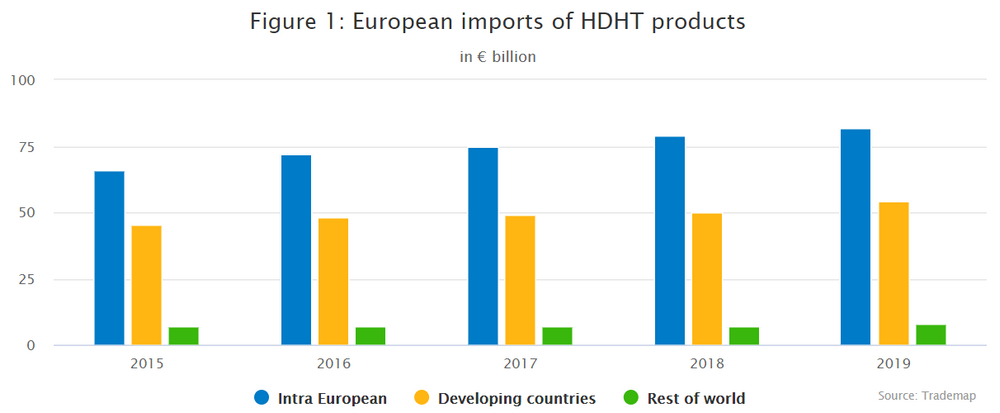

European imports of HDHT products grew steadily between 2015 and 2019 from €120 billion to €143 billion, at an average rate of 5.4% per year. Imports from developing countries grew from €47 billion to €54 billion, at an average annual rate of 3.2%. This adds up to an import market share of 38%. Because much of the intra-European trade consists of re-exported products from developing countries, the actual market share is likely to be considerably higher. This makes Europe an interesting market for you.

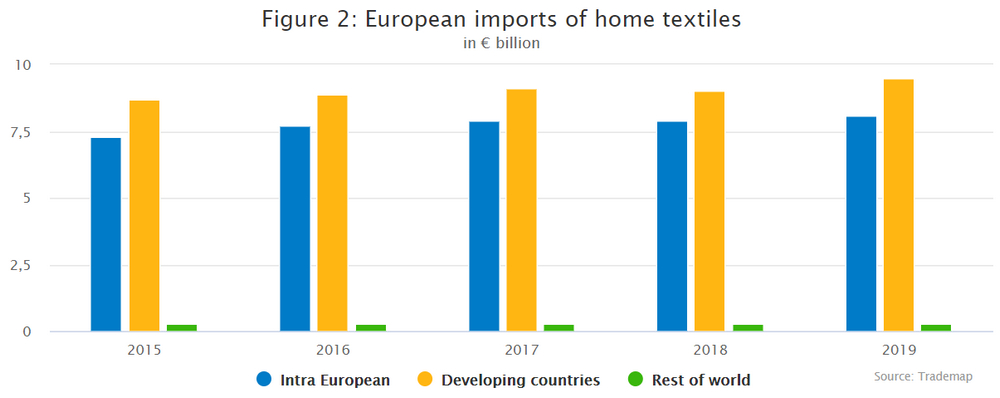

These data mainly reflect home decoration imports, which account for approximately 87% of all European HDHT imports. However, a closer look into home textile imports more specifically reveals a somewhat different pattern.

While European home textile imports also grew fairly steadily, most were actually directly sourced from developing countries. Out of a total value of €18 billion in 2019, developing countries supplied €9.5 billion worth of home textiles, adding up to an impressive European import market share of 53%.

China continues to be Europe’s leading HDHT supplier

China is Europe’s main HDHT supplier, accounting for 26% (€37 billion) of the total import value in 2019. This is more than the direct supplies of all other developing countries combined, adding up to an also considerable market share of 12%.

China is Europe’s main HDHT supplier, accounting for 26% (€37 billion) of the total import value in 2019. This is more than the direct supplies of all other developing countries combined, adding up to an also considerable market share of 12%.

The other leading suppliers are all European countries, trading within Europe. Germany is the largest of these intra-European suppliers, with 10% of the HDHT imports. Poland follows with 7%, the Netherlands with 6%, and France and Italy with 5% each.

However, you should be aware that European countries have different roles in the European market. You can make a rough distinction between countries that are mostly importers and countries that are mostly producers.

In general, Western European countries are mostly re-exporters. Most Western European importers do not just sell their imported products in their own country, but across Europe. European production mainly takes place in Eastern European countries. This is mostly because of their position within the EU and nearness to the main markets and their relatively low labour costs in comparison with Western European countries. This can make them a good alternative for sourcing low- to mid-end products. Western and southern European countries have a long history of producing high-end products from well-known premium brands.

Your focus should generally be on the mid to high-end market, which offers you good opportunities in terms of value addition and allows you to avoid competition from mass-producing low-cost countries in the lower ends of the market, such as China.

Other developing countries are also strengthening their position

China’s low-cost workforce, availability of raw materials and efficient shipping to Europe compared to other Asian countries make it the most competitive supplier. In the coming years however, disruptions following the country’s trade war with the United States and the COVID-19 pandemic may negatively impact its trade performance, which could create opportunities. With an average annual increase of 4.7%, European HDHT imports from all other developing countries combined are already growing at a higher rate than those from China (2.6%).

When it comes to total HDHT imports, Europe sourced €16 billion worth of products from developing countries other than China in 2019. The six leading suppliers among those are:

- India – €3.3 billion

- Vietnam – €2.9 billion

- Turkey – €2.7 billion

- Pakistan – €1.9 billion

- Indonesia – €971 million

- Bangladesh – €736 million

Categorising these imports reveals that developing countries actually supply more home textiles (€8.9 billion) than home decoration products (€7.6 billion), while China overwhelmingly focuses on home decoration (€37 billion versus €0.6 billion). Individual countries clearly vary in terms of the categories they focus on.

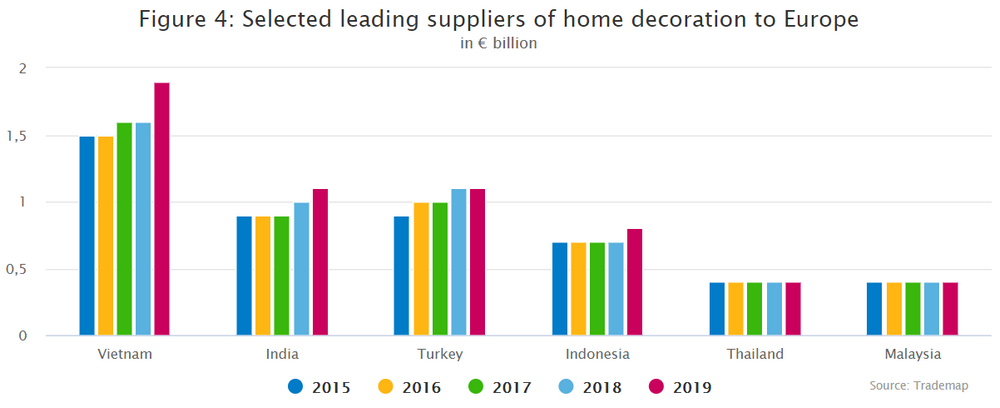

Home decoration supplies from developing countries other than China

Vietnam is the largest of these suppliers by far, with about a quarter of Europe’s home decoration imports from developing countries in 2019. India and Turkey follow with 15% each, while Indonesia provides a further 10%. All four of these relatively large players have increased their supplies to Europe in recent years, particularly in 2019. Thailand and Malaysia account for about 5% each, which they have kept fairly stable between 2015 and 2019.

Like China, Vietnam can produce high volumes at low costs. This puts Vietnam in a promising position to potentially benefit from the trade war between the United States and China. Although there are exceptions, of course, Vietnam mainly produces for the low-end segment with limited design value, which should not be your focus.

Manufacturers from India, Indonesia and Thailand generally represent more direct competition for you. These producers often have access to a wide range of natural materials and skilled craftsmanship, allowing them to compete in the mid- to high-end segments of the European market. These countries each have their own offering and established places in the market. Turkish suppliers benefit from their proximity to the European Union, allowing them to offer short delivery times. They provide a mix of industrial and handmade production, at relatively low costs.

While the home decoration category among developing countries is clearly dominated by South and South East Asia, Eastern Europe is on the rise. Just outside the top-six suppliers from developing countries, Ukraine, Bosnia and Herzegovina, Serbia and Belarus are emerging strongly. These countries benefit from being located close to the European Union market, while offering relatively affordable labour costs. If this trend continues, they could earn a place among the leading suppliers in the coming years.

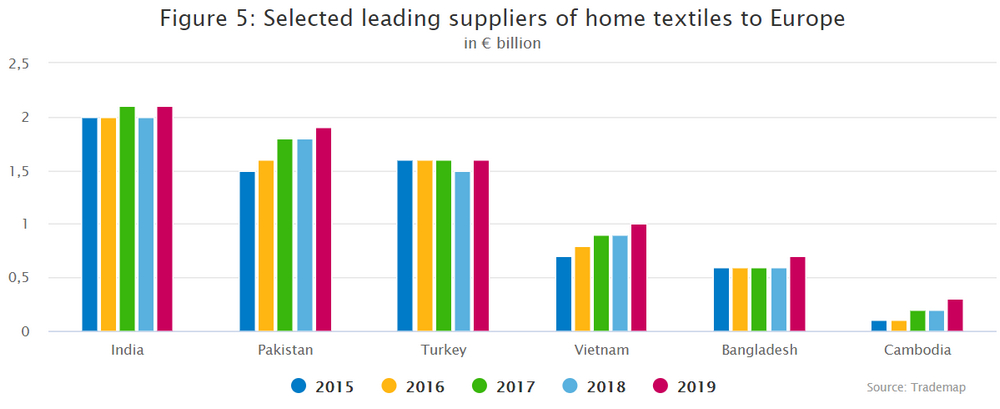

Home textile supplies from developing countries other than China

India and Pakistan are key players in the home textiles market. Together, these countries account for nearly half of Europe’s home textile imports from developing countries in 2019. Turkey supplies another 18%, while Vietnam follows at some distance with 12%. Bangladesh and Cambodia complete the top six with 7% and 3% respectively. All of these countries increased their supplies to Europe considerably between 2015 and 2019, except for Turkey. Cambodia is emerging particularly strongly, with an average annual growth rate of 29%.

As discussed, China plays a relatively small role in home textiles, ranking between Bangladesh and Cambodia with €0.6 billion in 2019. And this role is becoming even smaller, as China’s home textile supplies to Europe have shrunk by a hefty average rate of 13% per year since 2015.

Leading suppliers India and Pakistan are high-volume, low-pricing sourcing hubs for home textiles, with access to cheap and plentiful labour. Pakistan traditionally is one of the leading producers of cotton in the world and has a large spinning capacity to produce textile products from cotton. Like in the home decoration category, Turkish manufacturers benefit from their geographical proximity to the European Union and relatively low-cost labour compared to EU countries.

Vietnam’s high-volume, low-cost production makes the country an interesting alternative to China’s declining supplies. Again, rather than competing with these countries on price, your focus should be on the mid- to high-end segments. Bangladesh poses more direct competition to you because it offers buyers reasonable prices, a large skilled workforce and an abundance of natural materials from renewable sources. As an industrial manufacturer for large clothing brands, Cambodia mainly produces sleepwear and bags, rather than textiles for use around the house.

South and South East Asia clearly dominate the supplies of home textiles to Europe, not just among developing countries but worldwide. Unlike in home decoration, Eastern Europe plays a minor role in home textiles. Instead, Indonesia and Myanmar are advancing strongly. Northern African countries Egypt, Morocco and Tunisia are also fairly large suppliers, just behind the top six, however, their supplies were stable at best between 2015 and 2019.

Which European markets offer most opportunities for home decoration and home textiles?

The larger Western European economies are the main importers of HDHT products. However, importers in these countries generally sell their products across Europe. Your best strategy therefore is to focus on a particular segment, rather than a specific country.

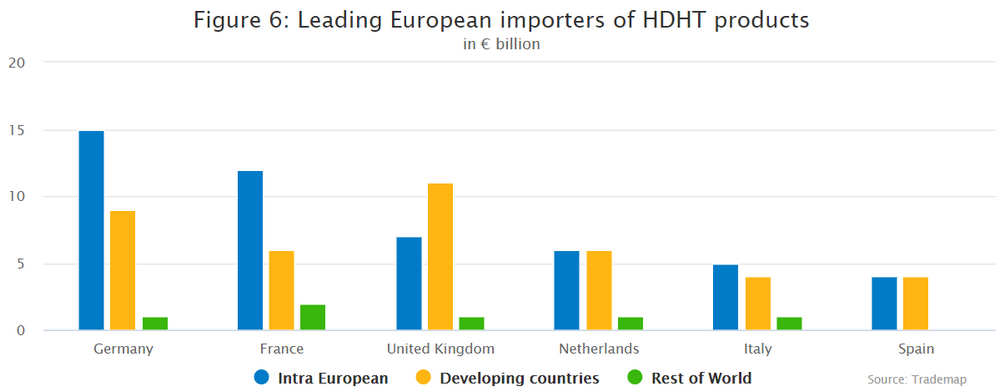

Germany is the leading European importer of HDHT products with 18% of the market, followed by France (14%) and the United Kingdom (13%). Together, they accounted for almost half of the total European HDHT imports. Smaller markets with shares smaller than 10%, but still in the top-six leading importing countries in Europe, are the Netherlands (9%), Italy (7%) and Spain (6%).

As discussed, most Western European importers re-export their imported products across Europe. This explains why in HDHT small countries like the Netherlands often import much more than the demand in their own domestic market.

In terms of marketing, bear in mind that individuals countries are not singular markets per se. The HDHT sector has different market segments ranging from low to high. Every European country has these segments, although their sizes may vary per country. Therefore, it makes much more sense for you to identify a particular segment in your product group and connect with importers and distributors in that segment, instead of focusing on a specific country. These distributors will then sell in that segment across Europe.

Germany is Europe’s largest importer

German HDHT imports steadily increased from €23 billion in 2015 to €26 billion in 2019, at an average annual rate of 2.6%. Approximately 35% (€9 billion) of these imports came directly from developing countries, which is comparable to the European average. Germany’s main leading suppliers from developing countries are India, Turkey, Vietnam and Pakistan, followed by Indonesia and Bangladesh.

In 2019, the total German HDHT import value consisted of €23 billion worth of home decoration products and €3.5 billion worth of home textiles. About one-third of home decoration imports originated straight from developing countries, while for home textiles this share was much larger at 51%. This also matches the general European pattern.

Germany is the largest economy in Europe, home to 19% of the European Union’s population. The German economy is widely considered the stabilising force within the European Union, historically showing a higher growth rate than other member states. In fact, according to the Economist Germany will be the first major European economy to recover from the current crisis. This expectation is based on both the country’s healthy finances before the crisis and its large industrial sector, whose restart will also benefit suppliers abroad.

In addition to having a large domestic market, Germany is also a key trade hub within Europe. In 2019, the country exported more than €20 billion worth of HDHT products, mainly to other European countries. Combined with a good-sized market for developing countries and the forecast economic recovery, this makes Germany an interesting market for you.

France’s offers opportunities for French-speaking suppliers

French HDHT imports grew from €17 billion to €20 billion between 2015 and 2019, at an average rate of 3.9% per year. Although this makes France the second largest HDHT importer in Europe, direct imports from developing countries is relatively small at 29%. Because of the sheer size of France’s total HDHT market, this translates into a fairly high value of €5.7 billion. India, Vietnam and Turkey are France’s leading suppliers from developing countries, followed by Pakistan and Tunisia. Opportunities for exporters in French-speaking countries like Tunisia are particularly good in this market, as the shared language makes it easier for French importers to do business with you.

French imports generally consist of 89% home decoration products and 11% home textiles, which is fairly consistent with the European average. Again, the market share of direct imports from developing country was much higher for home textiles (47%) than for home decoration (26%).

Economic growth in France has slowed down after a gradual recovery. Global uncertainties and the effects of social protests weighed on consumer confidence and the consumption of non-essential products. Due to its relatively large services sector, the French economy is expected to be slower to recover from the COVID-19 crisis than Germany’s. The combination of these factors makes it unlikely for French HDHT imports to continue growing at their current rate in the coming years.

The United Kingdom mainly imports directly from developing countries

The United Kingdom is by far Europe’s leading HDHT importer from developing countries. With an import market share of 58%, developing countries directly supply €11 billion worth of HDHT products. This value was relatively stable between 2015 and 2019. British total HDHT imports slightly increased from €18.6 billion to €19.1 million, at an average rate of 0.8%.

These imports are made up of 86% home decoration products (€16 billion) and 14% home textiles (€3 billion). While developing countries are the main source for both categories, their market share in home textile imports is particularly large at 68%. The United Kingdom’s main suppliers from developing countries are India, Vietnam, Pakistan and Turkey, followed by Malaysia, Bangladesh and Indonesia.

The United Kingdom’s withdrawal from the European Union may have a major impact on consumer confidence in the coming years. The uncertainties related to Brexit, the COVID-19 pandemic and the resulting economic slowdown are expected to affect the consumption of HDHT products. As such, your prospects for the next few years may more modest than the high import share of developing countries may suggest.

However, as a result of the Brexit-induced devaluation of the British pound (GBP), industry experts report that more British buyers have started importing directly from developing countries rather than via European re-exporters. This could offer you opportunities. As the situation surrounding Brexit is still fluid and insecure, you should keep a close watch on the developments.

The Netherlands is an important European trade hub

Although the Netherlands is a relatively small country, it is Europe’s fourth-largest HDHT importer. This is because the country is a key trade hub, re-exporting its imports across Europe. Between 2015 and 2019, Dutch HDHT imports surged from €8 billion to €13 billion, at an impressive average annual rate of more than 12%. This performance reflects a long period of consecutive economic growth for the Netherlands. Almost half of these imports came straight from developing countries, which is considerably above the European average.

In 2019, Dutch HDHT imports consisted of €12 billion worth of home decoration products and €1.4 billion worth of home textiles. The direct developing country share was relatively large for both categories, but particularly so for home textiles at 58%, matching the general European pattern. Vietnam and India are the Netherlands’ main suppliers from developing countries, followed by Indonesia, Pakistan and Turkey.

The Dutch economy seems to be among the less affected by the pandemic in Europe, as Dutch GDP is expected to return to its 2019 level at the end of 2022. However, because the Netherlands heavily depends on international trade, negative developments in that area strongly affect its economic performance. Brexit, the COVID-19 pandemic and international trade disputes, such as those between the United States and China, may have a big impact in the years to come.

Since the Netherlands is a big re-exporter of goods, demand from other European countries will also play a role. Given the economic slowdown in Europe as a whole, a significant increase in imports is not expected for the coming year. However, its strong performance as a European trade hub with a relatively large import share for developing countries continues to make the Netherlands an interesting market for you.

Italy is facing economic challenges

Italian HDHT imports increased from €9 billion in 2015 to €10 billion in 2019, at an average rate of 3.5% per year. Of these imports, 42% (€4 billion) was sourced directly from developing countries, somewhat above the European average.

In 2019, Italian HDHT imports were made up of €9 billion worth of home decoration products and €1 billion worth of home textiles. While the direct developing country import share for home decoration is fairly average at 38%, the share for home textiles (71%) is the highest of the leading European markets. Italy’s leading suppliers from developing countries are India and Turkey, followed by Pakistan and Vietnam.

Despite these relatively promising statistics, economic growth in Italy is likely to slow down as the country is particularly affected by the current pandemic. In fact, out of the major European economies, Italy is expected to be the slowest to recover. This is expected to put a damper on consumer confidence and the consumption of non-essential products in the coming years.

Spain also faces economic struggles

Between 2015 and 2019 Spanish HDHT imports increased from €7.3 billion to €8.5 billion, growing 3.9% per year on average. Around €4 billion of this came straight from developing countries, which translates to an above-average import market share of 45%.

Of this €8.5 billion, home decoration made up €7.3 billion and home textiles €1.2 billion. Like in the Netherlands, the direct developing country share was relatively large for both categories, but especially for home textiles at 68%. This reflects the general European pattern of comparatively high direct import values from developing countries in the home textiles category. India, Morocco and Pakistan are Spain’s main suppliers from developing countries, followed by Vietnam and Turkey.

Whether Spain can sustain its demand for HDHT products largely depends on the effects of the COVID-19 crisis. At the moment, the Economist expects the Spanish economy to experience the deepest contraction in Europe and be among the least recovered European economies by the end of 2021. This, of course, could limit your opportunities in Spain for the coming years.

Consumer spending is slowly bouncing back

An important indicator for growth in demand for HDHT products is real private consumption expenditure. The HDHT sector is sensitive to economic cycles. When economic circumstances and prospects are dim, consumers postpone buying non-essential items. The other way around, private consumption expenditure and purchases of non-essential HDHT products surge when economic conditions are favourable.

In recent years, the leading European markets showed an annual growth in real private consumption expenditure of 1%–3%. In emerging Eastern European markets, growth rates were even higher. For these emerging markets in particular, an increase in real private expenditure means consumers have more disposable income to spend on HDHT products.

Earlier forecasts for the coming year indicated this positive trend until the before the coronavirus pandemic. Now, predictions are uncertain. After a historic low at the outset of the crisis, consumer confidence is recovering (although it continues to be sensitive to changes in the circumstances), and spending is set to follow suit. For Western Europe as a whole, consumer spending is expected to return to its pre-pandemic level in 2022, led by essential purchases such as food.

Which products from developing countries have most potential in the European market?

Opportunities are generally good in the European HDHT market. Particularly promising product groups include basketry, home furniture, sleepwear and bathrobes, wooden kitchenware, paper-based stationery, and bathroom and kitchen textiles. These groups show good potential based on both recent trade statistics and current sector trends.

The HDHT sector is large and extremely diverse, even within the individual home decoration and home textile sub-sectors. These sub-sectors are further divided into categories, consisting of various product groups. Analysing these product groups can give you a broad idea of the most promising products for the European market. However, you should keep in mind that the true potential of a particular product also depends on factors including its quality, price, style, and design, and consequently which segment you target.

The European HDHT market generally offers you good opportunities, especially in the mid- to high-end segments. To appeal to consumers in these segments, your product needs to stand out. You should pay attention to design, decoration, craftsmanship and the story behind your products to differentiate from your competition. Using special materials, including sustainable materials, techniques and patterns are good ways to add value.

Highlighted below are six promising product groups from across the sector to give you an idea of the potential in the European market. Of course, opportunities are numerous and not limited to these product groups.

Basketry

A particularly well-performing product group is basketry. European basketry imports increased from €468 million in 2015 to €557 million in 2019. Although China is Europe’s leading supplier of basketry, Chinese supplies retracted from €252 million to €233 million, at an average annual rate of -2%. At the same time, European basketry imports from other developing countries, such as Vietnam and Bangladesh, surged by a combined 11% per year on average. In 2019, they reached €179 million, which adds up to a direct market share of 32%.

Besides having decorative value, baskets are functional storage items. This caters to the sector trends of shared living and wellness, as baskets allow consumers to create both physical and, consequently, mental space. The COVID-19 crisis has emphasised the relevance of these trends, as restrictions force people to spend more time together in relatively confined spaces.

Basketry also fits in well with the increased importance of sustainability, as about 80% of the basketry that Europe imports is made from natural materials. 12% of this is bamboo, 17% rattan and 71% ‘other’ natural materials, such as sea grass, jute, water hyacinth or abaca. However, using natural materials does not automatically make a product sustainable. The raw materials should come from responsibly managed, renewable sources, and paints and dyes should preferably be natural.

Picture 1: Woven baskets made from water hyacinth

Home furniture

A much broader (and therefore larger) product group than basketry, is that of home furniture. This group includes items such as various types of chairs, tables, beds, stools, poufs and sofas. European home furniture imports grew from €24 billion in 2015 to €31 billion in 2019. Although China supplied €8.2 billion of this, a further €3.6 billion was sourced directly from other developing countries, such as India. The imports from these developing countries grew at an average annual rate of 7.9%, which is considerably higher than China’s 4.8%.

Most of Europe’s home furniture imports are made from wood, including upholstered pieces with wooden frames. Other natural materials such as rattan, bamboo and cane are also growing, although this is a much smaller category within furniture. Indonesia is a particularly strong player when it comes to rattan.

Based on the trends of shared living and smaller urban living spaces, flexible furniture has particularly good potential. Pieces that are easy to move and/or modular (with individual components) allow consumers to rearrange their furniture according to their current needs. Items that are collapsible or can easily be stored offer extra space and flexibility. Again, these properties have become even more important due to the COVID-19 crisis. Spending more time at home in stressful times also creates a need for comfortable furniture, although budgets for large purchases may be limited.

Picture 2: Various types of flexible furniture pieces

Sleepwear and bathrobes

Sleepwear and bathrobes hold a special place in home textiles, as these are products you wear rather than use decoratively around the house. Between 2015 and 2019, European imports of sleepwear and bathrobes increased from €2.7 billion to €2.9 billion. Although China supplied 21% of this, developing countries that specialise in textiles, such as Pakistan, play a much larger role in this product group. Together they directly supplied €1.2 billion, or 42% of the import market. This resulted from an average annual growth of 3.7%, while China’s supplies declined.

While there is a lot of mass production in the home textiles sector from countries such as India and Pakistan, there are opportunities for smaller-scale producers with more attention to detail. Cotton is most commonly used, in various styles (such as terry or flannel), as well as synthetic fibres. More luxurious fabrics, such as silk, satin and cashmere, are also popular. In addition, there is an increasing interest in more sustainable options, such as organic cotton and bamboo fibres. Blends of different natural fibres are also possible.

Besides having purely functional properties, sleepwear and bathrobes also play a role in the wellness trend. Because a good night’s sleep is essential to a person’s sense of wellbeing, comfortable sleepwear is a must. And a luxurious, fluffy bathrobe adds to the relaxing spa experience that many consumers are recreating in their own home. As the COVID-19 pandemic has put a strain on people’s mental wellness, simple and affordable products that help consumers unwind and improve their wellbeing at home have good potential.

Wooden table and kitchenware

A relatively small but booming product group is that of wooden table and kitchenware. Between 2015 and 2019, European imports of wooden table and kitchenware grew from €383 million to €542 million. China supplied €269 million of it, making it the leading supplier. Imports from other developing countries such as Vietnam and Thailand reached €67 million, after realising an impressive average growth of more than 12% per year. This represents a direct market share of 12%.

Wooden table and kitchenware are increasingly popular as alternatives to products made from environmentally unfriendly materials, such as plastics. Bamboo is a particularly trendy material, commonly used to replace disposable cutlery, as single-use plastics are being phased out of the European market. Because it grows fast and is a naturally renewable resource, bamboo is considered a good sustainable option. For true sustainability however, it needs to be farmed and processed responsibly.

Picture 3: Bamboo cutlery set

Table and kitchenware play an important role in the ‘home sweet home’ trend, where friends and family enjoy cooking and dining together. They invest in good quality cook and dinnerware to create slow-dining experiences. During COVID-19 lockdowns, many European consumers have renewed their interest in cooking. This could further stimulate the demand for wooden table and kitchenware, particularly in combination with the increasing importance of sustainability.

Paper-based stationery

It may be unexpected in these digital times, but paper-based stationery offers good opportunities in the European market. European imports increased from €3.9 billion in 2015 to €4.5 billion in 2019. China supplied about 17% of it. Although the direct import market share of other developing countries, such as India, is relatively modest at 4%, it increased by more than 5% per year on average. At an absolute value of €176 million, comparable to that of basketry, these paper-based stationery imports are actually quite substantial.

This product group includes items such as notebooks, letter pads and post cards. These types of products form a countertrend to the increasing digitalisation of society. Many European consumers are finding a renewed appreciation for an offline, slower lifestyle. This fits in well with the wellness trend. Notebooks offer quality me time, allowing consumers to put their thoughts on paper, draw, or scrapbook. By writing letters and postcards to friends and family, consumers can show they care in a much more personal way than via digital messaging.

Picture 4: Notebook with felt cover

The COVID-19 crisis emphasises both the need to clear the mind and the need for meaningful connections with friends and family. At the same time, it has made communication even more digital than it already was. Paper stationary offers consumers a good alternative, and consequently has good potential for you. Particularly the more niche products offer you opportunities, such as stationery that incorporates sustainable values, handmade craftsmanship and options for personalisation. This also makes these products good gifts.

Bathroom and kitchen textiles

In home textiles, another product group with good potential is bathroom and kitchen textiles. Between 2015 and 2019, European imports of these products grew from €1.9 billion to €2.0 billion. Developing countries directly supply about two-thirds of this. Like with most home textiles, China’s role in this group is relatively minor at 12% of imports. This leaves much more room for low-cost, high-volume textile specialists, such as Pakistan and India, as well as smaller players that can produce more value-added items for the mid- to high-end markets.

Bathroom and kitchen textiles range from tea towels and oven mitts to bathmats and hammam towels. The most common material in this product group is cotton terry fabric, which is used for various types of towels, washcloths, etc. There is also a relatively small but stable market for products made from other natural materials, such as bamboo and hemp.

Like bathrobes, good quality bathroom textiles can enhance the at-home spa experience as part of the sector-wide wellness trend. Typical spa products such as hammam towels are especially suitable for this. Kitchen textiles on the other hand, cater to the increased interest in cooking and dining together within the ‘home sweet home’ trend. Both these trends are boosted by the COVID-19 pandemic, which has made consumers focus more on their wellness and helped them rediscover the joys of cooking.

Picture 5: Luxurious bath towel used to recreate the spa experience at home

This study was carried out on behalf of CBI by Globally Cool B.V. in collaboration with GO! GoodOpportunity and Remco Kemper.

(Courtesy: The Centre for the Promotion of Imports from developing countries – CBI)